Government Initiatives and Healthcare Reforms

Government initiatives aimed at improving healthcare access and affordability are influencing the total hip-knee-replacements market in China. Recent reforms have focused on expanding insurance coverage for orthopedic surgeries, which has made these procedures more accessible to a broader segment of the population. For instance, the inclusion of hip and knee replacements in the National Health Insurance scheme has led to a surge in surgeries performed. Data suggests that the number of hip replacements in China has increased by over 20% in recent years, reflecting the positive impact of these reforms. Additionally, the government is investing in healthcare infrastructure, which may further enhance the capacity for joint replacement surgeries. As a result, the total hip-knee-replacements market is poised for growth, driven by supportive policies and increased patient access.

Technological Innovations in Surgical Techniques

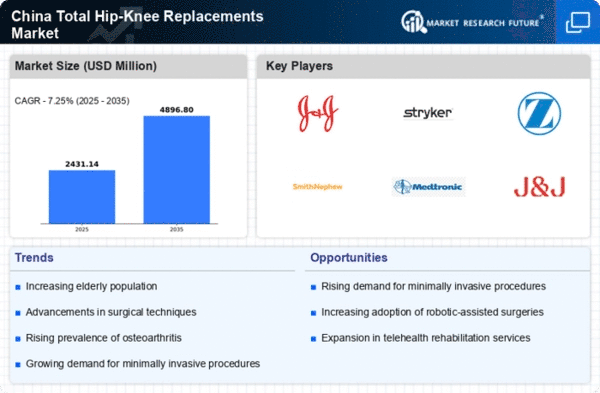

Technological innovations in surgical techniques are transforming the total hip-knee-replacements market in China. The adoption of robotic-assisted surgeries and computer-assisted navigation systems is enhancing the precision and efficiency of joint replacement procedures. These advancements not only improve surgical outcomes but also reduce the risk of complications, which is a critical concern for both patients and healthcare providers. Furthermore, the integration of 3D printing technology in the production of customized implants is gaining traction, allowing for better fit and functionality. As these technologies become more widely available, they are likely to attract more patients seeking effective solutions for joint disorders. Thus, the total hip-knee-replacements market is expected to benefit from these innovations, leading to increased adoption rates and improved patient outcomes.

Growing Awareness of Joint Health and Preventive Care

Growing awareness of joint health and preventive care is emerging as a key driver for the total hip-knee-replacements market in China. Public health campaigns and educational initiatives are increasingly informing the population about the importance of maintaining joint health and the available treatment options for joint disorders. This heightened awareness is encouraging individuals to seek medical advice earlier, leading to timely interventions and, in some cases, surgical procedures. Additionally, the rise of fitness and wellness trends has prompted more people to engage in activities that promote joint health, potentially reducing the incidence of severe joint issues. As a result, the total hip-knee-replacements market may see a rise in demand as individuals become more proactive about their joint health and seek surgical solutions when necessary.

Aging Population and Increased Incidence of Joint Disorders

The aging population in China is a primary driver for the total hip-knee-replacements market. As life expectancy rises, the prevalence of age-related joint disorders, such as osteoarthritis, increases significantly. Reports indicate that approximately 30% of individuals aged 65 and older experience some form of arthritis, leading to a higher demand for hip and knee replacement surgeries. This demographic shift necessitates enhanced healthcare services and surgical interventions, thereby propelling the market forward. Furthermore, the Chinese government has recognized the need for improved orthopedic care, which may lead to increased funding and resources allocated to joint replacement procedures. Consequently, the total hip-knee-replacements market is likely to expand as healthcare systems adapt to meet the needs of an aging population.

Rising Healthcare Expenditure and Investment in Orthopedic Services

The rising healthcare expenditure in China is a significant driver for the total hip-knee-replacements market. With healthcare spending projected to reach approximately $1 trillion by 2025, there is a growing investment in orthopedic services and technologies. This financial commitment is likely to enhance the availability of advanced surgical techniques and high-quality implants, which are crucial for successful joint replacement outcomes. Moreover, hospitals are increasingly adopting minimally invasive surgical methods, which can reduce recovery times and improve patient satisfaction. As healthcare facilities upgrade their capabilities, the demand for hip and knee replacements is expected to rise. Consequently, the total hip-knee-replacements market may experience substantial growth, fueled by increased investment in orthopedic care.