Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver for the telecom cloud market in China. As telecom operators face intense competition, they are increasingly seeking ways to reduce operational costs while enhancing service delivery. Cloud solutions offer scalable resources that allow companies to optimize their IT expenditures. By transitioning to cloud-based infrastructures, telecom operators can minimize capital investments in hardware and maintenance. Reports indicate that companies can achieve up to a 25% reduction in operational costs by leveraging cloud technologies. This financial incentive is likely to propel the adoption of telecom cloud solutions, as operators strive to maintain profitability in a challenging market.

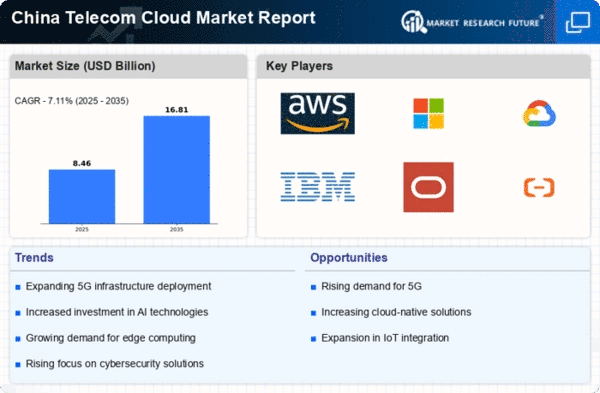

Growing Demand for 5G Infrastructure

The rapid rollout of 5G technology in China is significantly impacting the growth of the telecom cloud market. As mobile operators invest heavily in 5G infrastructure, the need for cloud-based solutions becomes increasingly apparent. This technology enables faster data processing and lower latency, which are essential for supporting the vast number of connected devices anticipated in the coming years. According to recent estimates, the telecom cloud market in China is projected to reach approximately $20 billion by 2026, fueled by the demand for enhanced connectivity and innovative services. The integration of 5G with cloud computing allows telecom operators to offer new applications, such as IoT services and smart city solutions. This integration expands their service portfolios and revenue streams.

Regulatory Support for Cloud Adoption

The Chinese government has been actively promoting the adoption of cloud technologies across various sectors, which significantly impacts the telecom cloud market. Initiatives aimed at digital transformation and the establishment of a robust cloud ecosystem are encouraging telecom operators to migrate to cloud-based solutions. Policies that support innovation and investment in cloud infrastructure are likely to enhance the competitive landscape. For instance, the government has set ambitious targets for cloud computing growth, aiming for a 30% increase in cloud service adoption by 2025. This regulatory environment fosters collaboration between telecom companies and cloud service providers, ultimately driving the expansion of the telecom cloud market.

Emergence of Innovative Service Offerings

The telecom cloud market is being propelled by innovative service offerings that leverage cloud technologies. Telecom operators in China are exploring new business models, such as Software as a Service (SaaS) and Platform as a Service (PaaS), to diversify their revenue streams. These models allow operators to provide value-added services, such as virtualized network functions and enhanced customer engagement platforms. The potential for creating tailored solutions for specific industries, such as healthcare and education, is also driving interest in telecom cloud services. As operators innovate and expand their service portfolios, the telecom cloud market is likely to witness substantial growth in the coming years.

Rising Need for Data Analytics Capabilities

The telecom cloud market is experiencing growth due to the rising need for advanced data analytics capabilities. Telecom operators in China are increasingly recognizing the value of data-driven decision-making to enhance customer experiences and optimize network performance. Cloud-based analytics solutions enable real-time processing of vast amounts of data, allowing operators to gain insights into user behavior and network usage patterns. This trend is expected to drive investments in cloud analytics tools, with the market projected to grow by 15% annually. As operators seek to leverage data for competitive advantage, the demand for telecom cloud solutions that incorporate analytics functionalities is likely to increase.