Regulatory Compliance Pressures

In China, the tax accounting-software market is heavily influenced by the increasing pressures of regulatory compliance. The government has implemented stringent tax regulations, necessitating that businesses maintain accurate records and submit timely reports. This environment creates a substantial demand for software solutions that can assist in navigating complex tax laws and ensuring compliance. As of 2025, it is estimated that around 70% of companies are investing in tax software to mitigate risks associated with non-compliance. The ability of software to automate compliance processes and provide real-time updates on regulatory changes is becoming a critical factor for businesses. This trend indicates that the tax accounting-software market will continue to thrive as organizations prioritize compliance and seek reliable tools to manage their tax obligations.

Increasing Demand for Digital Solutions

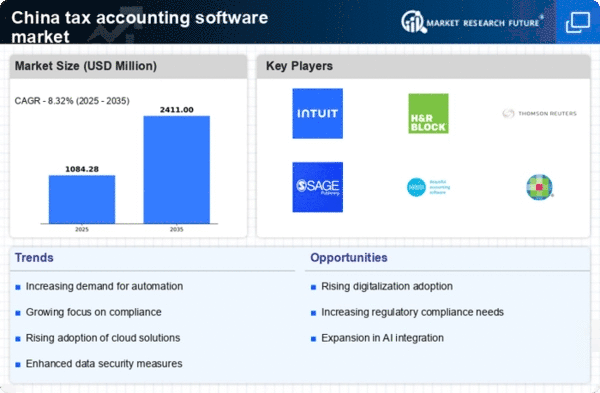

The tax accounting-software market in China is experiencing a notable surge in demand for digital solutions. As businesses increasingly recognize the efficiency and accuracy that software can provide, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. This shift towards digitalization is driven by the need for streamlined tax processes and improved data management. Companies are seeking software that not only simplifies tax calculations but also enhances reporting capabilities. The growing adoption of e-invoicing and electronic tax filing further propels this trend, as organizations aim to comply with regulatory requirements while minimizing manual errors. Consequently, the tax accounting-software market is likely to expand significantly as more businesses transition from traditional methods to advanced digital solutions.

Rising Awareness of Tax Planning Strategies

The tax accounting-software market in China is witnessing a rise in awareness regarding tax planning strategies among businesses. As organizations strive to optimize their tax liabilities, there is an increasing recognition of the importance of effective tax planning. This trend is likely to drive demand for software that not only assists in compliance but also provides insights into tax-saving opportunities. Recent surveys indicate that around 55% of businesses are now prioritizing tax planning as a critical component of their financial strategy. Consequently, software solutions that offer comprehensive tax planning features are expected to gain traction in the market. This growing focus on strategic tax management indicates a promising outlook for the tax accounting-software market as it evolves to meet the needs of businesses seeking to enhance their financial performance.

Growth of Small and Medium Enterprises (SMEs)

The tax accounting-software market in China is significantly impacted by the growth of small and medium enterprises (SMEs). As SMEs constitute a substantial portion of the economy, their increasing number is driving demand for accessible and affordable tax solutions. Recent data suggests that SMEs account for over 60% of the total employment in the country, highlighting their importance. These businesses often lack the resources for extensive accounting departments, making tax software an attractive option for managing their financial obligations efficiently. The market is likely to see a rise in tailored solutions designed specifically for SMEs, which could enhance their operational efficiency and compliance with tax regulations. This trend indicates a promising future for the tax accounting-software market as it adapts to the needs of a growing SME sector.

Technological Advancements in Software Development

Technological advancements are playing a pivotal role in shaping the tax accounting-software market in China. Innovations such as machine learning, data analytics, and cloud computing are enhancing the capabilities of tax software, making it more user-friendly and efficient. As of November 2025, it is estimated that approximately 40% of tax software solutions incorporate advanced technologies to improve functionality. These advancements allow for better data processing, predictive analytics, and enhanced security features, which are crucial for businesses handling sensitive financial information. The continuous evolution of technology suggests that the tax accounting-software market will remain dynamic, with new features and improvements being introduced regularly to meet the changing demands of users.