Emergence of 5G Technology

The rollout of 5G technology in China is poised to have a transformative impact on the system on-chip market. With the increasing demand for high-speed connectivity and low latency, there is a pressing need for advanced chips that can support 5G applications. In 2025, the 5G infrastructure investment in China is expected to exceed $50 billion, creating a robust market for system on-chip solutions designed specifically for 5G devices. These chips must accommodate higher data rates and support multiple frequency bands, which presents both challenges and opportunities for manufacturers. The system on-chip market is likely to see a surge in innovation as companies strive to develop solutions that meet the stringent requirements of 5G technology. This trend may lead to increased collaboration between telecom operators and chip manufacturers, further driving advancements in the sector.

Advancements in IoT Applications

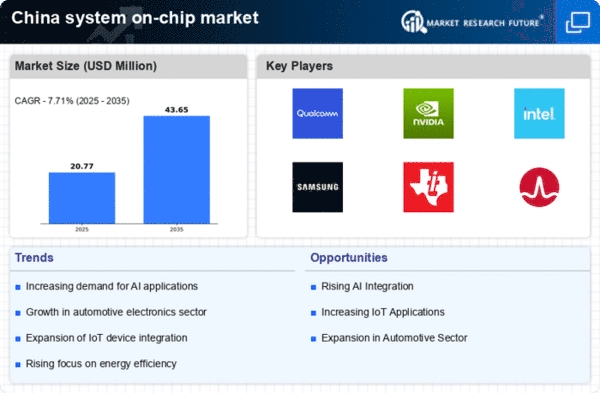

The rapid expansion of Internet of Things (IoT) applications in China significantly influences the system on-chip market. As industries increasingly adopt IoT technologies for automation and data collection, the demand for specialized chips that can handle diverse applications grows. In 2025, the IoT market in China is projected to reach $100 billion, creating a substantial opportunity for the system on-chip market. These chips must be capable of processing large volumes of data while maintaining low power consumption, which is essential for battery-operated devices. The integration of advanced features such as connectivity and security within a single chip is becoming a necessity. Consequently, manufacturers are likely to focus on developing innovative system on-chip solutions tailored for IoT applications, thereby driving growth and enhancing the competitive landscape within the market.

Government Initiatives and Support

The Chinese government plays a pivotal role in fostering the growth of the system on-chip market through various initiatives and support programs. Policies aimed at promoting semiconductor manufacturing and research have been implemented, with significant investments allocated to enhance domestic capabilities. In 2025, the government is expected to invest over $30 billion in the semiconductor sector, which includes the development of system on-chip technologies. This support not only encourages local companies to innovate but also attracts foreign investments, thereby strengthening the overall ecosystem. The system on-chip market benefits from these initiatives as they facilitate collaboration between academia and industry, leading to advancements in chip design and manufacturing processes. Furthermore, the government's focus on self-sufficiency in technology is likely to drive demand for locally produced system on-chip solutions, further propelling market growth.

Surge in Consumer Electronics Demand

The system on-chip market in China experiences a notable surge in demand driven by the increasing consumption of consumer electronics. With the proliferation of smartphones, tablets, and smart home devices, the need for efficient and compact chip solutions becomes paramount. In 2025, the consumer electronics sector is projected to contribute approximately $200 billion to the overall electronics market in China. This growth necessitates advanced system on-chip solutions that can integrate multiple functionalities into a single chip, thereby enhancing performance while reducing space and power consumption. As manufacturers strive to meet consumer expectations for high-performance devices, the system on-chip market is likely to witness substantial growth, with innovations aimed at improving processing power and energy efficiency. The competitive landscape is expected to intensify as companies invest in research and development to create cutting-edge solutions that cater to evolving consumer preferences.

Growing Focus on Automotive Electronics

The automotive sector in China is undergoing a significant transformation, with an increasing emphasis on electronics and smart technologies. The system on-chip market is likely to benefit from this trend as vehicles become more connected and autonomous. In 2025, the automotive electronics market in China is projected to reach $80 billion, highlighting the demand for sophisticated system on-chip solutions that can manage various functions such as infotainment, navigation, and advanced driver-assistance systems (ADAS). As automakers seek to enhance vehicle performance and safety, the need for integrated chip solutions becomes critical. The system on-chip market is expected to witness growth as manufacturers develop chips that can handle complex tasks while ensuring reliability and efficiency. This shift towards smart vehicles may also encourage partnerships between automotive and semiconductor companies, fostering innovation in the market.