Growth of E-commerce Platforms

The rapid expansion of e-commerce platforms in China is significantly influencing the subscriber data-management market. With the e-commerce sector projected to reach $2 trillion by 2025, businesses are increasingly focused on optimizing their subscriber data to enhance customer experiences. E-commerce companies are leveraging subscriber data-management systems to gain insights into consumer behavior, preferences, and purchasing patterns. This data-driven approach enables them to tailor marketing strategies and improve customer retention rates. As a result, the subscriber data-management market is likely to witness increased investments from e-commerce businesses seeking to harness the potential of subscriber data for competitive advantage. The integration of advanced data management solutions will be crucial for these companies to effectively manage and analyze the growing volumes of subscriber data generated through online transactions.

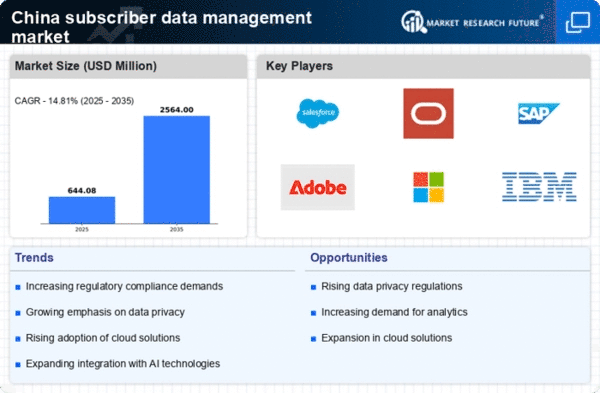

Rising Demand for Data Analytics

The subscriber data-management market in China is experiencing a notable surge in demand for data analytics solutions. As businesses increasingly recognize the value of data-driven decision-making, the need for sophisticated analytics tools has become paramount. In 2025, the market for data analytics in China is projected to reach approximately $10 billion, reflecting a growth rate of around 25% annually. This trend is likely to drive investments in subscriber data-management systems that can efficiently process and analyze vast amounts of subscriber data. Companies are seeking to leverage insights derived from data analytics to enhance customer engagement and optimize marketing strategies. Consequently, the subscriber data-management market is poised to benefit from this growing emphasis on analytics, as organizations strive to harness the power of data to gain a competitive edge.

Regulatory Compliance Requirements

In China, the regulatory landscape surrounding data management is evolving rapidly, impacting the subscriber data-management market. The implementation of stringent data protection laws necessitates that organizations adhere to compliance requirements, which in turn drives the demand for robust data management solutions. As of November 2025, companies are required to ensure that their subscriber data practices align with national regulations, including the Personal Information Protection Law (PIPL). This law mandates transparency in data collection and processing, compelling businesses to invest in subscriber data-management systems that facilitate compliance. The market is likely to see a significant uptick in demand for solutions that offer features such as data encryption, access controls, and audit trails, ensuring that organizations can navigate the complexities of regulatory compliance while effectively managing subscriber data.

Increased Focus on Customer Experience

The subscriber data-management market in China is witnessing a heightened focus on customer experience, which is driving the demand for effective data management solutions. Companies are increasingly recognizing that understanding subscriber preferences and behaviors is essential for delivering personalized experiences. As of November 2025, organizations are investing in subscriber data-management systems that enable them to collect, analyze, and utilize subscriber data to enhance customer interactions. This trend is reflected in the growing emphasis on customer-centric strategies, with businesses aiming to improve satisfaction and loyalty. the subscriber data-management market is likely to see a surge in demand for solutions that facilitate seamless integration of customer data across various touchpoints. This will allow organizations to create cohesive and engaging experiences for their subscribers.

Technological Advancements in Data Management

Technological advancements are playing a pivotal role in shaping the subscriber data-management market in China. Innovations such as artificial intelligence (AI) and machine learning (ML) are enhancing the capabilities of data management systems, enabling organizations to automate processes and derive actionable insights from subscriber data. As of November 2025, the adoption of AI-driven data management solutions is expected to increase, with a projected market growth of 30% in this segment. These technologies allow businesses to analyze subscriber data in real-time, facilitating personalized marketing efforts and improving customer engagement. The subscriber data-management market is likely to benefit from this trend, as organizations seek to leverage cutting-edge technologies to optimize their data management practices and enhance overall operational efficiency.