Rising Commercial Applications

The space based-network market is witnessing a surge in commercial applications across various sectors in China. Industries such as agriculture, transportation, and disaster management are increasingly leveraging satellite technology for enhanced operational efficiency. For instance, satellite imagery is being utilized for precision agriculture, enabling farmers to optimize crop yields. The market for satellite-based services in agriculture alone is projected to grow by over 20% annually. This trend indicates a broader acceptance of satellite solutions in commercial sectors, thereby driving the space based-network market. As businesses recognize the value of satellite communications, investment in this area is expected to rise.

Growing Demand for Connectivity

The increasing demand for high-speed internet and reliable communication services in China is driving the space based-network market. With a population exceeding 1.4 billion, the need for enhanced connectivity is paramount. Urbanization and the proliferation of smart devices contribute to this demand. According to recent estimates, the number of internet users in China reached approximately 1 billion, indicating a penetration rate of around 70%. This surge in connectivity needs is prompting investments in satellite networks to ensure coverage in remote and rural areas. The space based-network market is thus positioned to expand significantly as both private and public sectors seek to address these connectivity challenges.

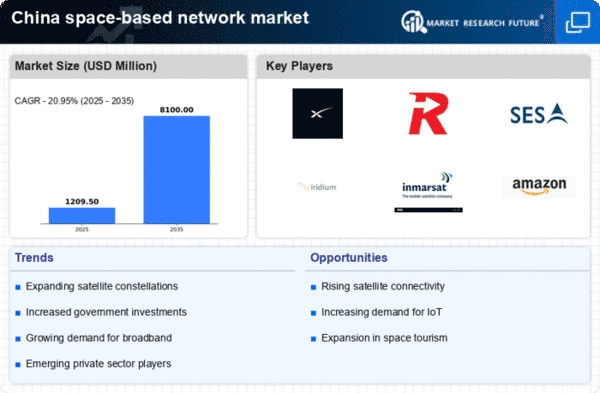

Government Initiatives and Investments

The Chinese government is actively promoting the development of the space based-network market through various initiatives and funding programs. The 14th Five-Year Plan emphasizes advancements in space technology, including satellite communications. In 2021, the government allocated over $1 billion to enhance satellite infrastructure, aiming to improve national security and economic competitiveness. This strategic focus on space technology is likely to bolster the space based-network market, as it encourages collaboration between state-owned enterprises and private companies. The government's commitment to fostering innovation in this sector may lead to the establishment of new satellite constellations and improved service offerings.

International Collaboration and Partnerships

International collaboration is emerging as a key driver for the space based-network market in China. Partnerships with foreign entities are facilitating knowledge transfer and technology sharing, which are crucial for advancing satellite communications. For example, collaborations with European and Asian countries have led to joint satellite missions and research initiatives. These partnerships not only enhance technological capabilities but also open new markets for Chinese satellite services. The space based-network market stands to benefit from these international alliances, as they may lead to increased investment and innovation, ultimately expanding the reach and effectiveness of satellite networks.

Technological Advancements in Satellite Systems

Technological advancements in satellite systems are significantly influencing the space based-network market. Innovations such as low Earth orbit (LEO) satellites are enhancing data transmission speeds and reducing latency. China's recent launches of LEO satellites, including the Tiantong-1 series, demonstrate the country's commitment to improving satellite communication capabilities. These advancements are likely to attract more users and applications, thereby expanding the market. The space based-network market is poised for growth as these technologies become more accessible and affordable, enabling a wider range of services and applications across different sectors.