Rising Cyber Threats

The increasing frequency and sophistication of cyber threats poses a significant challenge to the smart grid-security market. In China, the number of cyber incidents targeting critical infrastructure has surged, prompting a heightened focus on security measures. Reports indicate that the energy sector has experienced a 30% rise in cyberattacks over the past year. This alarming trend necessitates the adoption of advanced security solutions to protect sensitive data and ensure the integrity of the grid. As a result, investments in cybersecurity technologies are expected to grow, with the smart grid-security market projected to reach $5 billion by 2027. The urgency to safeguard against these threats drives innovation and the development of robust security frameworks within the industry.

Technological Advancements

Rapid technological advancements in the field of cybersecurity are significantly influencing the smart grid-security market. Innovations such as machine learning, blockchain, and advanced encryption techniques are being integrated into security solutions to enhance the resilience of smart grids. In China, the adoption of these technologies is expected to increase, with a projected market growth of 20% by 2026. The integration of artificial intelligence into security systems allows for real-time threat detection and response, thereby improving the overall security posture of the grid. As these technologies evolve, they present new opportunities for companies operating within the smart grid-security market to develop cutting-edge solutions that address emerging threats.

Government Initiatives and Policies

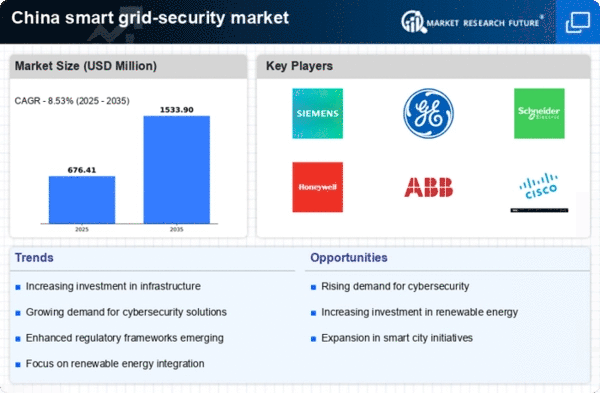

The Chinese government has implemented various initiatives aimed at enhancing the security of critical infrastructure, including the smart grid-security market. Policies such as the Cybersecurity Law and the National Cybersecurity Strategy emphasize the importance of securing energy systems against potential threats. These regulations encourage investments in security technologies and promote collaboration between public and private sectors. As a result, the market is likely to witness a compound annual growth rate (CAGR) of 15% over the next five years. The proactive stance of the government in establishing a regulatory framework fosters a conducive environment for the growth of the smart grid-security market, ensuring that security measures are prioritized in the development of smart grid technologies.

Growing Public Awareness and Concerns

Public awareness regarding cybersecurity threats has increased significantly in China, influencing the smart grid-security market. As citizens become more informed about the potential risks associated with smart grid technologies, there is a growing demand for transparency and accountability from energy providers. This heightened awareness is prompting companies to invest in more robust security measures to build trust with consumers. Surveys indicate that 70% of the population expresses concern over the security of their energy systems. In response, the smart grid-security market is likely to see a surge in demand for solutions that not only protect infrastructure but also address public concerns, thereby fostering a more secure energy landscape.

Increased Demand for Renewable Energy

The transition towards renewable energy sources in China is driving the need for enhanced security measures within the smart grid-security market. As the country aims to achieve its carbon neutrality goals by 2060, the integration of renewable energy sources such as solar and wind into the grid presents unique security challenges. The decentralized nature of these energy sources requires robust security protocols to protect against potential vulnerabilities. Consequently, the smart grid-security market is expected to expand, with an estimated growth rate of 18% over the next five years. This shift towards renewables necessitates the development of innovative security solutions that can effectively safeguard the integrity and reliability of the grid.