Growing Demand for Automation

The service lifecycle-management market in China is experiencing a significant increase in demand for automation solutions. As businesses strive to enhance operational efficiency, the integration of automated processes is becoming increasingly prevalent. This trend is driven by the need to reduce manual errors and improve service delivery times. According to recent data, the automation segment within the service lifecycle-management market is projected to grow at a CAGR of approximately 15% over the next five years. Companies are investing in advanced software tools that facilitate seamless service management, thereby optimizing resource allocation and minimizing costs. This growing demand for automation not only streamlines operations but also enhances customer satisfaction, as services are delivered more promptly and accurately.

Expansion of Service Offerings

The service lifecycle-management market in China is witnessing an expansion of service offerings as companies strive to differentiate themselves in a competitive landscape. Organizations are increasingly diversifying their service portfolios to meet the evolving needs of customers. This trend is driven by the demand for comprehensive service solutions that encompass various aspects of lifecycle management, from planning to execution and support. As businesses seek to provide end-to-end service management, the market is expected to grow significantly, with an estimated increase of 18% in service offerings over the next few years. This expansion not only enhances customer satisfaction but also allows companies to capture new revenue streams, thereby solidifying their position in the service lifecycle-management market.

Regulatory Compliance and Standards

In China, the service lifecycle-management market is significantly influenced by the evolving landscape of regulatory compliance and industry standards. As businesses face increasing scrutiny from regulatory bodies, adherence to compliance requirements has become paramount. This has led to a heightened focus on implementing robust service lifecycle-management practices that align with national regulations. Companies are investing in solutions that ensure compliance with data protection laws and industry-specific standards, which is expected to drive market growth. The market is projected to expand as organizations prioritize compliance-driven service management strategies, potentially increasing the overall market size by 20% in the coming years. This focus on regulatory compliance not only mitigates risks but also enhances the credibility of service providers in the eyes of consumers.

Rising Importance of Data Analytics

The service lifecycle-management market in China is increasingly shaped by the rising importance of data analytics. Organizations are recognizing the value of data-driven decision-making in optimizing service delivery and enhancing customer experiences. By leveraging analytics tools, companies can gain insights into service performance, customer preferences, and operational inefficiencies. This trend is expected to propel the market forward, with data analytics solutions projected to account for approximately 30% of the overall service lifecycle-management market by 2026. The ability to analyze vast amounts of data allows businesses to make informed decisions, tailor services to meet customer needs, and ultimately drive revenue growth. As data analytics continues to evolve, its integration into service lifecycle-management practices is likely to become a critical differentiator for companies in the competitive landscape.

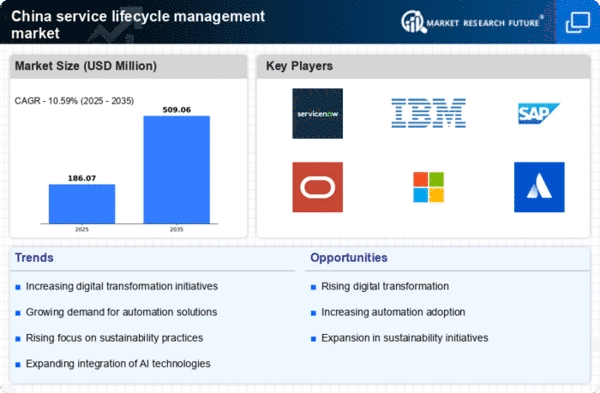

Increased Focus on Digital Transformation

Digital transformation is a key driver of change within the service lifecycle-management market in China. As organizations seek to modernize their operations, the adoption of digital technologies is becoming essential. This transformation encompasses the implementation of cloud-based solutions, mobile applications, and IoT devices, which facilitate real-time service management. The market is witnessing a shift towards digital-first strategies, with companies investing heavily in technology to enhance service delivery and customer engagement. It is estimated that the digital transformation initiatives could contribute to a market growth of around 25% over the next few years. This increased focus on digital solutions not only improves operational efficiency but also positions companies to better respond to evolving customer expectations in a rapidly changing marketplace.