Rising Demand for Data Analytics

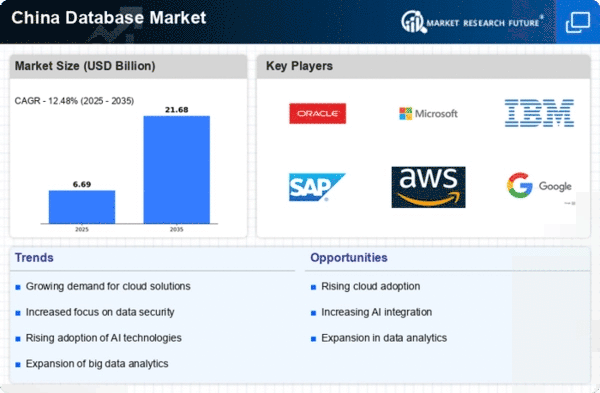

The increasing need for data-driven decision-making is propelling the relational database market in China. Organizations are recognizing the value of data analytics to enhance operational efficiency and customer insights. As a result, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is largely attributed to the adoption of advanced analytics tools that rely on relational databases for data storage and retrieval. Companies are investing in relational database solutions to manage vast amounts of data generated from various sources, thereby driving the demand for robust database management systems. The relational database market is thus witnessing a surge in investments aimed at improving data analytics capabilities, which is essential for maintaining competitive advantage in a rapidly evolving business landscape.

Focus on Enhanced User Experience

In the competitive landscape of the relational database market, enhancing user experience has become a key driver. Companies are increasingly prioritizing user-friendly interfaces and improved performance in their database solutions. This focus is essential for attracting and retaining customers, as organizations seek to streamline their operations and reduce the complexity of data management. The relational database market is responding to this demand by developing innovative features that cater to user needs, such as simplified data access and real-time analytics. As businesses recognize the importance of user experience in database management, investments in relational database technologies are expected to rise, further propelling market growth.

Emergence of Big Data Technologies

The rise of big data technologies is reshaping the relational database market landscape in China. Organizations are increasingly adopting big data solutions to process and analyze large datasets, which necessitates the use of relational databases for structured data management. This trend is indicative of a broader shift towards integrated data ecosystems, where relational databases play a crucial role in ensuring data integrity and accessibility. The relational database market is likely to see a significant uptick in demand as businesses seek to combine traditional relational database systems with big data technologies. This integration is essential for organizations aiming to harness the full potential of their data assets.

Government Initiatives and Support

The Chinese government is actively promoting digital transformation across various sectors, which is positively impacting the relational database market. Initiatives aimed at enhancing technological infrastructure and encouraging innovation are leading to increased investments in database technologies. For instance, the government has allocated substantial funding to support research and development in information technology, which includes relational database systems. This support is expected to boost the market, as organizations leverage government resources to upgrade their database capabilities. The relational database market is likely to benefit from these initiatives, as they facilitate the adoption of modern database solutions that align with national strategies for economic growth and technological advancement.

Growth of E-Commerce and Online Services

The rapid expansion of e-commerce and online services in China is significantly influencing the relational database market. As more businesses transition to digital platforms, the demand for efficient data management solutions has surged. E-commerce companies require robust relational databases to handle large volumes of transactions and customer data securely. This trend is reflected in the market, which is expected to reach a valuation of over $10 billion by 2026. The relational database market is thus experiencing heightened activity as companies seek to implement scalable database solutions that can support their growing online operations. This growth is further fueled by the increasing consumer preference for online shopping and digital services.