Rising Internet Penetration

The increasing internet penetration in China is a crucial driver for the recommendation search-engine market. As of 2025, approximately 70% of the population has access to the internet, which facilitates the growth of online services. This connectivity allows users to engage with recommendation systems more effectively, enhancing their overall experience. The recommendation search-engine market benefits from this trend, as more users online translates to a larger audience for personalized content. Furthermore, the rise of mobile internet usage, which accounts for over 90% of total internet access, indicates a shift towards mobile-friendly recommendation engines. This shift is likely to drive innovation and competition within the market, as companies strive to optimize their services for mobile users.

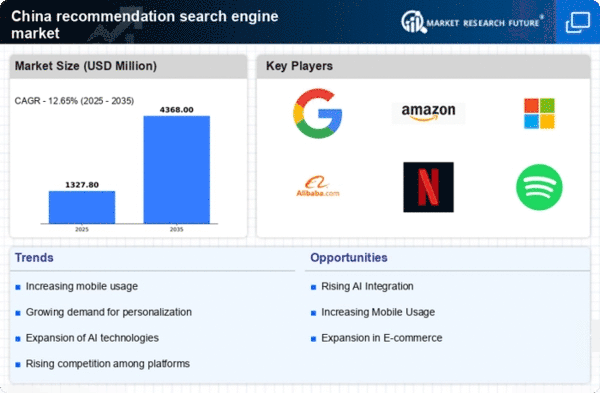

Expansion of E-commerce Sector

The rapid expansion of the e-commerce sector in China serves as a significant driver for the recommendation search-engine market. With e-commerce sales projected to reach over $2 trillion by 2025, businesses are increasingly leveraging recommendation engines to enhance customer experience and boost sales. The recommendation search-engine market plays a vital role in this growth, as these engines help consumers discover products that align with their preferences. As competition intensifies among e-commerce platforms, the integration of advanced recommendation systems becomes essential for retaining customers. Moreover, the ability to provide personalized shopping experiences is likely to lead to increased customer loyalty and repeat purchases, further solidifying the market's importance in the e-commerce landscape.

Growing Mobile Commerce Trends

The growing trends in mobile commerce are significantly influencing the recommendation search-engine market in China. With mobile devices accounting for over 70% of e-commerce transactions, businesses are increasingly focusing on optimizing their recommendation systems for mobile platforms. This shift is crucial, as users expect seamless and personalized experiences on their smartphones. The recommendation search-engine market is adapting by developing mobile-friendly interfaces and algorithms that cater to on-the-go consumers. Additionally, the rise of mobile payment solutions has further facilitated this trend, making it easier for users to act on recommendations. As mobile commerce continues to expand, the demand for effective recommendation engines that enhance user experience is likely to grow, driving innovation and competition within the market.

Technological Advancements in AI

Technological advancements in artificial intelligence (AI) are transforming the recommendation search-engine market in China. The integration of AI technologies enables more accurate and efficient recommendation systems, which can analyze vast amounts of data to deliver personalized content. As of 2025, it is estimated that AI-driven recommendation engines can improve user engagement by up to 40%. This capability is particularly relevant in sectors such as entertainment and retail, where user preferences are diverse and dynamic. The recommendation search-engine market is likely to see increased investment in AI research and development, as companies strive to enhance their algorithms and maintain a competitive edge. Furthermore, the potential for AI to predict user behavior and preferences could lead to even more tailored recommendations, further driving market growth.

Increased Demand for Personalized Content

The demand for personalized content in China is rapidly growing, significantly impacting the recommendation search-engine market. Consumers are increasingly seeking tailored experiences, which has led to a surge in the use of recommendation engines across various sectors, including e-commerce, entertainment, and social media. Reports indicate that around 60% of users prefer platforms that offer personalized recommendations, suggesting that businesses must adapt to these preferences to remain competitive. The recommendation search-engine market is responding by developing more sophisticated algorithms that analyze user behavior and preferences. This trend not only enhances user satisfaction but also drives higher conversion rates for businesses, as personalized recommendations are known to increase sales by up to 30%.