Increasing Urbanization

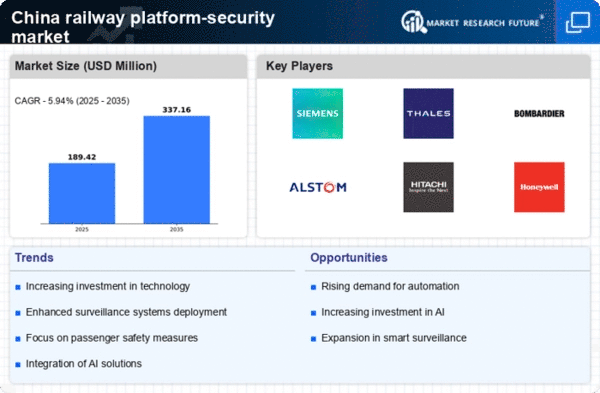

The rapid urbanization in China is driving the demand for enhanced railway platform-security measures. As cities expand and populations grow, the number of railway users increases significantly. This surge in passenger volume necessitates robust security systems to ensure safety and prevent incidents. the railway platform-security market is projected to see a rise in investments, with projections indicating a growth rate of approximately 8% annually.. Urban areas, particularly megacities like Beijing and Shanghai, are prioritizing security upgrades to manage the influx of commuters. Consequently, the railway platform-security market is expected to evolve, incorporating advanced technologies such as AI and facial recognition to address the challenges posed by urban density.

Rising Security Threats

The increasing frequency of security threats, including terrorism and vandalism, is a significant concern for railway operators in China. These threats have prompted a reevaluation of existing security protocols, leading to a heightened focus on the railway platform-security market. In response to these challenges, railway authorities are investing in comprehensive security assessments and upgrades. The market is expected to expand as operators seek to implement more stringent security measures, including enhanced surveillance and emergency response systems. The potential for a 15% increase in security-related expenditures over the next few years indicates a proactive approach to addressing these threats, thereby driving growth in the railway platform-security market.

Government Initiatives and Funding

The Chinese government has been actively promoting initiatives aimed at enhancing transportation security, which directly impacts the railway platform-security market. Significant funding has been allocated to improve infrastructure and implement advanced security technologies. Reports suggest that the government plans to invest over $10 billion in railway security enhancements over the next five years. This financial commitment indicates a strong focus on safeguarding public transport systems, thereby stimulating growth in the railway platform-security market. The collaboration between government bodies and private sector firms is likely to foster innovation, leading to the development of more effective security solutions tailored to the unique challenges faced by railway platforms.

Public Awareness and Demand for Safety

There is a growing public awareness regarding safety and security in public transportation systems in China. Passengers are increasingly concerned about their safety while using railway services, which has led to a demand for improved security measures at railway platforms. This heightened awareness is influencing railway operators to prioritize security investments, thereby impacting the railway platform-security market. Surveys indicate that over 70% of commuters express a desire for enhanced security features, such as increased surveillance and better emergency protocols. This shift in consumer expectations is likely to drive innovation and investment in the railway platform-security market, as operators strive to meet the demands of safety-conscious passengers.

Technological Advancements in Security Systems

The continuous evolution of technology is a key driver for the railway platform-security market in China. Innovations such as biometric systems, automated surveillance, and smart monitoring solutions are becoming increasingly prevalent. These advancements not only enhance security but also improve operational efficiency. The integration of Internet of Things (IoT) devices allows for real-time monitoring and data analysis, which is crucial for preemptive security measures. the railway platform-security market is expected to grow by approximately 10% annually as stakeholders adopt these technologies to mitigate risks.. As a result, the demand for sophisticated security solutions is expected to rise, reflecting the need for modernized security frameworks in railway systems.