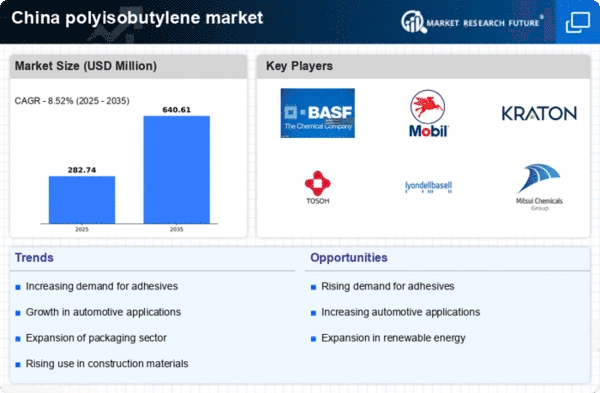

The polyisobutylene market in China is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as BASF SE (DE), ExxonMobil Chemical (US), and Kraton Corporation (US) are actively pursuing strategies that enhance their market positioning. BASF SE (DE) focuses on expanding its product portfolio through innovation, while ExxonMobil Chemical (US) emphasizes operational efficiency and sustainability in its manufacturing processes. Kraton Corporation (US) is leveraging its expertise in bio-based materials to cater to the growing demand for environmentally friendly products. Collectively, these strategies contribute to a dynamic competitive environment where differentiation is increasingly based on technological advancements and sustainable practices.In terms of business tactics, companies are localizing manufacturing to better serve the Chinese market, which appears to be a response to the increasing demand for polyisobutylene in various applications, including adhesives and sealants. The market structure is moderately fragmented, with several key players holding significant market shares. This fragmentation allows for a diverse range of products and innovations, although it also intensifies competition among established and emerging players.

In October ExxonMobil Chemical (US) announced a strategic partnership with a local Chinese firm to enhance its supply chain capabilities. This collaboration is expected to optimize logistics and reduce operational costs, thereby improving the company's competitive edge in the region. Such partnerships are crucial as they enable companies to navigate local market dynamics more effectively and respond to customer needs with greater agility.

In September BASF SE (DE) launched a new line of polyisobutylene products designed specifically for the automotive sector. This move is significant as it aligns with the growing trend towards lightweight materials in vehicle manufacturing, potentially capturing a larger share of the automotive market. The introduction of these products not only showcases BASF's commitment to innovation but also reflects the increasing demand for high-performance materials in the automotive industry.

In August Kraton Corporation (US) expanded its production capacity in China to meet the rising demand for sustainable polyisobutylene solutions. This expansion is indicative of the company's strategic focus on sustainability and its intent to lead in the bio-based materials segment. By increasing production capacity, Kraton positions itself to capitalize on the growing consumer preference for environmentally friendly products, thereby enhancing its competitive stance.

As of November the competitive trends in the polyisobutylene market are increasingly influenced by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, allowing companies to pool resources and expertise to drive innovation. The competitive landscape is shifting from traditional price-based competition to a focus on technological differentiation, supply chain reliability, and sustainable practices. This evolution suggests that companies that prioritize innovation and sustainability will likely emerge as leaders in the market.