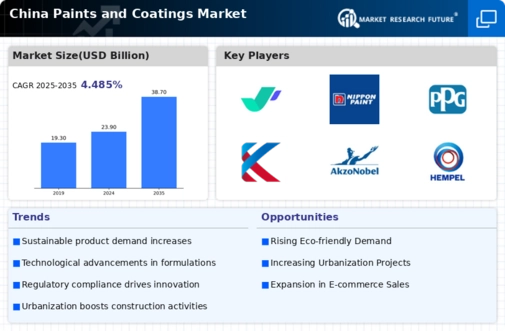

The paints coatings market in China is currently experiencing a dynamic transformation, driven by various factors including urbanization, industrial growth, and evolving consumer preferences. The demand for high-performance coatings is on the rise, as industries seek solutions that offer durability, aesthetic appeal, and environmental compliance. Innovations in formulation technology are enabling manufacturers to develop products that meet stringent regulations while also addressing the need for sustainability. This shift is likely to influence the competitive landscape, as companies adapt to changing market conditions and consumer expectations. Moreover, the increasing focus on eco-friendly products is reshaping the paints coatings market. Consumers are becoming more aware of the environmental impact of their choices, prompting manufacturers to invest in sustainable practices and materials. Water-based coatings, low-VOC options, and bio-based formulations are gaining traction as viable alternatives to traditional products. This trend not only aligns with regulatory requirements but also caters to a growing segment of environmentally conscious consumers. As these developments unfold, the paints coatings market is poised for continued growth, reflecting broader economic and social trends in China.

Sustainability Initiatives

the paints coatings market is experiencing a significant shift towards sustainability. Manufacturers are increasingly adopting eco-friendly practices, focusing on low-VOC and water-based formulations. This trend is driven by consumer demand for environmentally responsible products, as well as regulatory pressures aimed at reducing harmful emissions. Companies are investing in research and development to create innovative solutions that minimize environmental impact while maintaining performance.

Technological Advancements

Technological innovation plays a crucial role in shaping the paints coatings market. Advances in formulation chemistry are leading to the development of high-performance coatings that offer enhanced durability and aesthetic qualities. These innovations not only improve product performance but also enable manufacturers to meet stringent regulatory standards. As technology continues to evolve, it is expected to drive further growth and diversification within the market.

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development in China are significantly influencing the paints coatings market. The demand for residential and commercial construction is driving the need for a variety of coatings solutions. This trend is likely to continue as urban areas expand, creating opportunities for manufacturers to supply products that cater to diverse applications, from protective coatings to decorative finishes.