Aging Population

China's demographic shift towards an aging population significantly impacts the overactive bladder-treatment market. By 2025, it is projected that over 20% of the population will be aged 60 and above, a demographic that is particularly susceptible to OAB. This age group often experiences various comorbidities that exacerbate bladder issues, leading to a higher demand for effective treatment solutions. The healthcare system is likely to adapt to this demographic change by increasing the availability of specialized care and treatment options for older adults. Consequently, pharmaceutical companies may focus on developing age-appropriate therapies, which could enhance the overall market landscape for OAB treatments.

Increasing Prevalence of OAB

The rising incidence of overactive bladder (OAB) in China is a crucial driver for the overactive bladder-treatment market. Recent studies indicate that approximately 16% of the adult population in China experiences symptoms of OAB, which translates to millions of individuals seeking effective treatment options. This growing prevalence is likely to stimulate demand for various therapeutic interventions, including medications and lifestyle modifications. As awareness of OAB increases, healthcare providers are more inclined to diagnose and treat this condition, further propelling market growth. The increasing burden of OAB on healthcare systems may also lead to enhanced funding and resources allocated for research and development in this area, thereby fostering innovation in treatment modalities.

Growing Focus on Mental Health

The increasing recognition of the interplay between physical and mental health is emerging as a significant driver for the overactive bladder-treatment market. In China, there is a growing awareness that OAB can adversely affect mental well-being, leading to anxiety and depression among patients. This understanding is prompting healthcare providers to adopt a more holistic approach to treatment, integrating psychological support with traditional medical interventions. As mental health becomes a focal point in patient care, the demand for comprehensive treatment plans that address both physical and psychological aspects of OAB is likely to rise. This shift may encourage the development of multidisciplinary treatment programs, thereby expanding the market and improving patient outcomes.

Increased Healthcare Expenditure

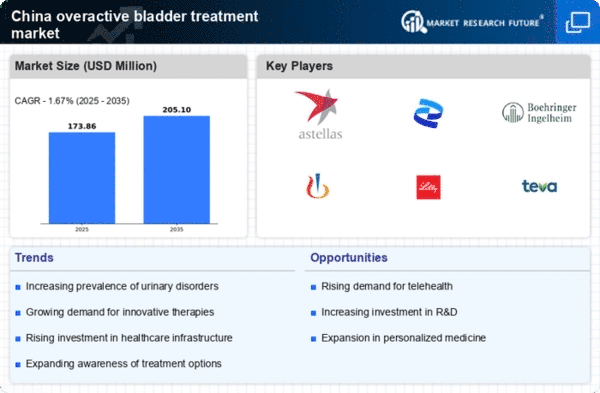

The rising healthcare expenditure in China is a pivotal factor influencing the overactive bladder-treatment market. With the government's commitment to improving healthcare access and quality, spending on healthcare services has seen a notable increase. In 2025, healthcare expenditure is expected to reach approximately 7.5% of GDP, which may facilitate better access to OAB treatments. This increase in funding could lead to enhanced availability of medications, therapies, and healthcare services for patients suffering from OAB. Furthermore, as more individuals seek treatment, the market may witness a corresponding rise in investment from pharmaceutical companies aiming to capture this growing segment, thereby fostering competition and innovation.

Advancements in Treatment Options

The overactive bladder-treatment market is experiencing a surge in innovative treatment options, which is a significant driver of market growth. Recent advancements in pharmacological therapies, including the introduction of new anticholinergic medications and beta-3 adrenergic agonists, have expanded the therapeutic arsenal available to healthcare providers. Additionally, minimally invasive surgical techniques and neuromodulation therapies are gaining traction as viable alternatives for patients who do not respond to conventional treatments. This diversification of treatment options is likely to cater to a broader patient demographic, thereby enhancing market penetration. As these advancements continue to evolve, they may lead to improved patient outcomes and satisfaction, further driving the market.