Growing Focus on Sustainability

Sustainability has become a pivotal concern for the oil and gas industry in China, influencing the oil gas-cloud-applications market. Companies are increasingly leveraging cloud applications to monitor and manage their environmental impact. The ability to analyze data related to emissions, resource consumption, and waste management in real-time allows firms to implement more sustainable practices. As of November 2025, it is anticipated that the integration of cloud solutions could result in a 15% reduction in carbon emissions for major oil and gas companies. This growing focus on sustainability not only aligns with global environmental goals but also enhances corporate reputation and compliance with regulatory standards.

Government Initiatives and Support

The Chinese government is actively promoting the adoption of cloud technologies within the oil and gas sector. Various initiatives aimed at enhancing digital infrastructure and encouraging innovation are being implemented. For instance, the government has allocated substantial funding to support research and development in cloud applications tailored for the oil and gas industry. This support is expected to foster a conducive environment for the growth of the oil gas-cloud-applications market. By 2025, government policies may lead to a projected increase in cloud adoption rates by approximately 30%, thereby enhancing the overall efficiency and competitiveness of the sector.

Advancements in IoT and Connectivity

The rapid advancements in Internet of Things (IoT) technologies are significantly impacting the oil gas-cloud-applications market in China. The integration of IoT devices with cloud applications enables real-time monitoring and data collection from various operational sites. This connectivity facilitates predictive maintenance, enhances safety protocols, and optimizes resource allocation. As the number of connected devices in the oil and gas sector continues to rise, it is projected that the market for cloud applications will expand by approximately 25% by 2025. This trend underscores the importance of leveraging IoT capabilities to drive innovation and efficiency within the industry.

Rising Demand for Operational Efficiency

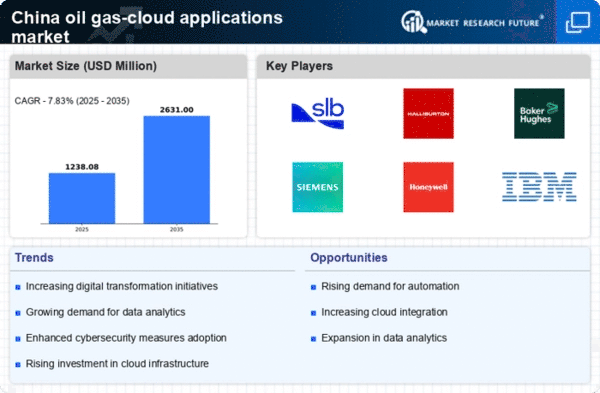

The oil gas-cloud-applications market in China is experiencing a notable surge in demand for operational efficiency. Companies are increasingly adopting cloud-based solutions to streamline their operations, reduce costs, and enhance productivity. The integration of cloud applications allows for real-time data access and improved collaboration among teams, which is crucial in a sector characterized by complex supply chains and regulatory requirements. As of 2025, it is estimated that the operational efficiency improvements could lead to cost reductions of up to 20% for major players in the industry. This trend indicates a shift towards digital transformation, where traditional practices are being replaced by innovative cloud technologies, thereby driving growth in the oil gas-cloud-applications market.

Increased Investment in Digital Transformation

Investment in digital transformation initiatives is a key driver for the oil gas-cloud-applications market in China. Companies are recognizing the necessity of modernizing their operations to remain competitive in a rapidly evolving landscape. The shift towards cloud-based solutions is seen as a strategic move to enhance agility, scalability, and data-driven decision-making. By 2025, it is estimated that investments in digital transformation within the oil and gas sector could reach upwards of $10 billion, reflecting a commitment to adopting advanced technologies. This influx of capital is likely to accelerate the growth of the oil gas-cloud-applications market, as firms seek to harness the benefits of cloud computing.