Technological Advancements

Technological advancements are significantly influencing the mobile biometric-security-service market in China. Innovations in artificial intelligence and machine learning are enhancing the accuracy and efficiency of biometric systems, making them more appealing to consumers. For instance, facial recognition technology has improved, with accuracy rates exceeding 95% in various applications. This has led to a surge in adoption across multiple sectors, including retail and transportation. Furthermore, the integration of biometric systems with mobile devices is streamlining user experiences, allowing for seamless authentication processes. As technology continues to evolve, the mobile biometric-security-service market is expected to expand, driven by the demand for cutting-edge security solutions that meet the needs of a tech-savvy population.

Increasing Security Concerns

The mobile biometric-security-service market in China is experiencing growth driven by escalating security concerns among consumers and businesses. With rising incidents of identity theft and cybercrime, there is a heightened demand for secure authentication methods. According to recent data, approximately 70% of Chinese consumers express anxiety regarding data breaches, prompting organizations to adopt biometric solutions. This trend is particularly evident in sectors such as finance and e-commerce, where secure transactions are paramount. The mobile biometric-security-service market is thus positioned to address these concerns, offering solutions that enhance user trust and protect sensitive information. As security becomes a priority, the market is likely to see increased investments in biometric technologies, further solidifying its role in safeguarding personal and financial data.

Consumer Demand for Convenience

Consumer demand for convenience is a pivotal factor influencing the mobile biometric-security-service market in China. As lifestyles become increasingly fast-paced, individuals seek authentication methods that are not only secure but also quick and easy to use. Biometric solutions, such as fingerprint and facial recognition, offer a seamless user experience, allowing for rapid access to devices and services. Recent surveys indicate that over 60% of consumers prefer biometric authentication over traditional methods due to its convenience. This shift in consumer preference is prompting businesses to adopt biometric technologies, thereby driving growth in the mobile biometric-security-service market. As convenience continues to be a priority for consumers, the market is expected to expand further.

Growing Mobile Payment Ecosystem

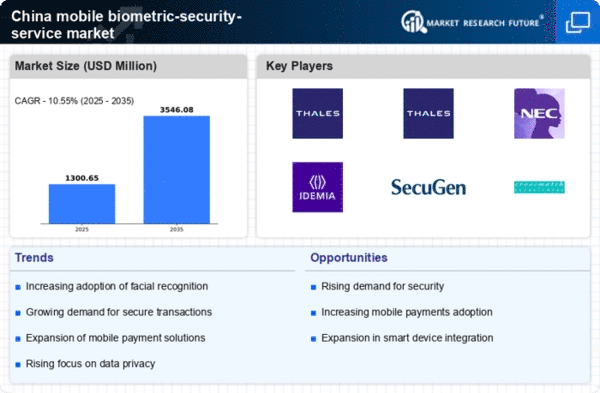

The expansion of the mobile payment ecosystem in China is a crucial driver for the mobile biometric-security-service market. With the increasing prevalence of mobile payment platforms, such as Alipay and WeChat Pay, there is a pressing need for secure authentication methods. Recent statistics indicate that mobile payments accounted for over 50% of total transactions in China, underscoring the importance of security in this domain. Biometric authentication offers a robust solution to mitigate fraud risks associated with mobile payments. As consumers become more reliant on these platforms, the mobile biometric-security-service market is likely to see accelerated growth, as businesses seek to implement secure and user-friendly payment solutions.

Regulatory Support and Compliance

Regulatory support and compliance requirements are shaping the mobile biometric-security-service market in China. The government has introduced various regulations aimed at enhancing data protection and privacy, which in turn drives the adoption of biometric technologies. For example, the Personal Information Protection Law (PIPL) emphasizes the need for secure data handling practices, encouraging organizations to implement biometric solutions that comply with these regulations. This creates a favorable environment for the mobile biometric-security-service market, as businesses seek to align with legal standards while enhancing their security measures. The interplay between regulatory frameworks and market demand is likely to foster innovation and growth within the sector.