China Military Communication Market

China Military Communication Market Size, Share, Industry Trend & Analysis Research Report By Platform (Airborne, Ground Base, Naval), By Type (Satellite Communication, Radio Communication), and By Application (Command & Control, Situational Awareness, Routine Operations, Others)-Forecast to 2035

China Military Communication Market Overview

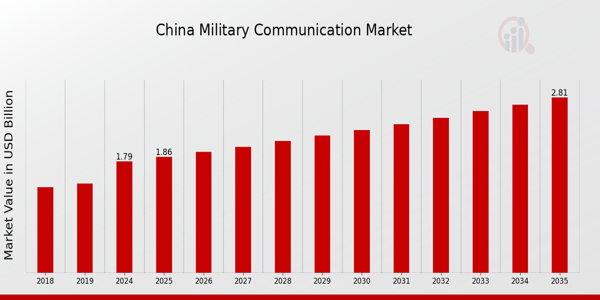

As per MRFR analysis, the China Military Communication Market Size was estimated at 1.75 (USD Billion) in 2023.The China Military Communication Market is expected to grow from 1.79(USD Billion) in 2024 to 2.8 (USD Billion) by 2035. The China Military Communication Market CAGR (growth rate) is expected to be around 4.174% during the forecast period (2025 - 2035).

Key China Military Communication Market Trends Highlighted

The strategic requirement of modern warfare and technology improvement are driving notable trends in the China military communication market. The focus on enhancing secure communication systems in the military is one of the main factors driving the market.

In order to improve communication capabilities, the Chinese government is making significant investments in R&D, with a special emphasis on network-centric warfare and satellite communications. The military has prioritised cybersecurity measures due to the increase in cyber threats, which has led to advancements in encrypted communication technologies.

There are chances for regional manufacturers to collaborate with global technological companies in order to improve their capabilities. The possibility for incorporating 5G systems into military operations to guarantee real-time communication and data transfer during missions is increasing due to the technology's quick development.

Businesses now have the opportunity to provide state-of-the-art communication solutions created especially for defence applications because to the growing focus on defence modernisation. Artificial Intelligence (AI) integration into military communication systems has been increasingly popular in recent years.

AI can improve decision-making, anticipate possible problems, and optimise communication frameworks. Smart communication technologies that can operate across a variety of terrains and difficult conditions are being intensively pursued by the Chinese military.

As China seeks to improve its military readiness and operational efficiency, this emphasis on next-generation technologies is changing the country's military communication environment. All things considered, these patterns show a push for modernisation and improved communication skills, establishing China as a major force in the field of international military communication.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

China Military Communication Market Drivers

Increased Defense Budget Allocation

China's government has been consistently increasing its defense budget over the years, with reports from the Ministry of Finance indicating a rise of 6.8% in defense spending in the fiscal year.

This increased funding enables advanced technologies for communication systems within the China Military Communication Market, facilitating the development of sophisticated military communication networks. Such investments are vital for addressing the emerging threats and enhancing overall military readiness.

The establishment of the China Electronics Technology Group Corporation emphasizes this focus, as it has dedicated resources toward next-generation military communication technologies.

Furthermore, as the government aims to modernize its military capabilities, it is expected that the defense budget will continue to grow, supporting an estimated compound annual growth rate (CAGR) of 4.174% from 2025 to 2035, showcasing a healthy outlook for the China Military Communication Market.

Technological Advancements in Communication Systems

The rapid advancements in communication technologies, including the adoption of 5G, pose a significant driver for the China Military Communication Market. The Ministry of Industry and Information Technology of China has reported a national strategy aimed at promoting 5G technology, which enhances communication speed and reliability.

Major corporations such as Huawei Technologies Co., Ltd. are at the forefront, investing heavily in research and development of military-grade communication infrastructure to meet increasing demands.

In the previous year, Huawei announced over 1.5 billion USD allocated to projects focused on developing secure communication networks for military applications. As these technological enhancements are integrated, they are expected to revolutionize military operations, contributing to the market's overall growth.

Geopolitical Tensions and Regional Security Concerns

The noticeable rise in geopolitical tensions and regional security threats is a significant driver impacting the China Military Communication Market. The Ministry of National Defense has highlighted ongoing security concerns along its borders with neighboring countries, necessitating the enhancement of military communication capabilities.

As a result, military organizations are adapting by prioritizing investment in communication platforms that ensure secure and rapid information dissemination.

For instance, recent tensions in the South China Sea have prompted military exercises that heavily rely on advanced communication technologies. This trend underlines the urgency for China to bolster its military communication frameworks, thereby creating an environment conducive to sustained market growth amidst evolving security challenges.

China Military Communication Market Segment Insights

Military Communication Market Platform Insights

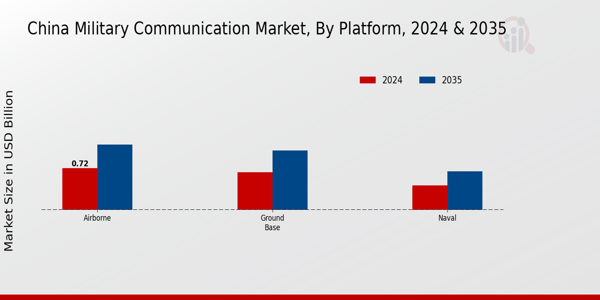

The Platform segment of the China Military Communication Market plays a vital role in enhancing the operational capabilities and strategic communication of the military. This segment is characterized by three primary categories: Airborne, Ground Based, and Naval platforms, each of which serves critical functions in ensuring secure and effective communication during military operations.

The Airborne category, encompassing communication systems integrated into aircraft and unmanned aerial vehicles, significantly enhances real-time data sharing and situational awareness, which are essential for modern air operations.

Meanwhile, Ground Based platforms are fundamental in establishing robust communication infrastructures that support joint operations, command and control, and intelligence sharing across various military branches.

These systems are often deployed in a modular fashion, allowing flexibility and scalability to adapt to different mission requirements. Naval platforms, tailored for maritime operations, integrate advanced communication technologies to facilitate seamless inter-ship connectivity and coordination with shore-based facilities, thereby ensuring comprehensive maritime domain awareness.

The significance of these platforms in the China Military Communication Market is underscored by the government's ongoing investments in defense modernization and enhancements in telecommunications infrastructure, driven by the need for secure and reliable communication networks.

Overall, robust market growth is fueled by the increasing complexity of military operations and the rising emphasis on maintaining communication superiority amid emerging geostrategic challenges in the region.

As the market continually evolves, advancements in technology and increased budget allocations will likely contribute to the enhancement of these platforms, solidifying their importance in the broader context of military communication strategies within China.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Military Communication Market Type Insights

The China Military Communication Market has been characterized by its diverse Type segment, primarily encompassing Satellite Communication and Radio Communication, which serve critical roles in national defense and security operations.

Satellite Communication is essential for wide-area communication, providing secure and reliable connectivity for military missions, especially in remote and hard-to-reach areas, thus enhancing battlefield coordination. Meanwhile, Radio Communication remains a vital component due to its proven effectiveness in tactical situations, offering immediate and direct communication capabilities.

As China continues to invest in advancing its military capabilities, both these types are expected to exhibit significant growth, driven by increasing demand for enhanced communication technologies and integration with digital advancements.

Furthermore, the government's modernization efforts, coupled with defense spending increases, contribute to the evolving landscape of the China Military Communication Market, emphasizing the importance of these communication types in maintaining operational readiness.

Adapting to emerging technological trends while addressing associated challenges will define the strategic direction of the market. Potential opportunities also exist in enhancing cybersecurity measures to protect vital communication networks, thereby ensuring secure military operations in a rapidly changing global environment.

Military Communication Market Application Insights

The Application segment of the China Military Communication Market plays a crucial role in enhancing the operational effectiveness of the military, with diverse applications including Command and Control, Situational Awareness, Routine Operations, and others.

Command and Control is vital as it enables strategic decision-making and efficient resource allocation during missions, significantly influencing operational success. Situational Awareness is equally important, providing military forces with real-time data for threat assessment and tactical responses, ensuring safety and mission effectiveness.

Routine Operations encompass everyday communications and coordination, which are foundational for maintaining a functional military environment. The segment also comprises other applications that support specific military functions, highlighting the versatility and adaptability of communication systems in diverse operational contexts.

As China continues to invest in modernizing its military capabilities, the importance of this segment will likely grow, driven by advancements in technology and an increasing focus on data-driven decision-making. The China Military Communication Market segmentation demonstrates a comprehensive landscape, reflecting a clear alignment with the country's defense strategies and growth ambitions.

China Military Communication Market Key Players and Competitive Insights

The China Military Communication Market has been undergoing significant transformation, driven by advancements in technology, increased defense spending, and enhanced demand for secure communication systems.

As military operations become increasingly reliant on effective communication networks, various players within the industry are vying for a competitive edge. The focus has shifted toward not just upgrading existing infrastructure but also integrating innovative solutions that can support the complex demands of modern warfare.

The interplay of public and private sector collaboration is becoming increasingly vital, as companies endeavor to meet the sophisticated technological needs of the country’s armed forces amid a backdrop of evolving global security challenges.

China Mobile has established itself as a significant entity within the China Military Communication Market. The strength of China Mobile lies in its extensive infrastructure, which provides robust communication capabilities that are essential for military operations.

The company has made considerable investments to enhance its network reliability and bandwidth, facilitating real-time data sharing and communication across various military branches. With a vast user base and an expansive telecommunications network, China Mobile is uniquely positioned to leverage its technology to support military communication needs.

Its ability to integrate cutting-edge technologies such as 5G into military applications adds to its strength, enabling faster and more secure communication, ultimately enhancing operational efficacy for the Chinese military.

The China State Shipbuilding Corporation plays a pivotal role in the China Military Communication Market through its diverse portfolio of advanced solutions and services tailored for naval operations. The corporation is recognized for its production of naval platforms that incorporate sophisticated communication systems, facilitating seamless communication and coordination during missions.

This integration of technology within its shipbuilding capabilities ensures that the Chinese Navy remains at the forefront of maritime operations. Additionally, the company has engaged in strategic mergers and acquisitions to enhance its technological prowess, further solidifying its market presence.

Through endeavors such as these, China State Shipbuilding Corporation has continuously expanded its influence within the military communication sector, providing reliable and refined communication solutions tailored to the specific needs of the military in the Chinese region.

Key Companies in the China Military Communication Market Include

- China Mobile

- China State Shipbuilding Corporation

- ZTE

- China South Industries Group

- China North Industries Corp

- Huawei

- China National Chemical Corporation

- China Unicom

- Datang Telecom Technology

- North Industries Group

- China Electronics Technology Group

- China National Electronics Import & Export Corporation

- CETC

- China Aviation Industry Corporation

- China Telecom

China Military Communication Market Developments

The China Military Communication Market has recently seen significant developments, particularly with advancements in technology integration among major players. China Mobile has been expanding its 5G capabilities tailored for military applications, enhancing secure communications across branches.

Notably, in June 2023, China State Shipbuilding Corporation partnered with China Electronics Technology Group to optimize naval communication systems. Meanwhile, Huawei continues to make strides in quantum communication technologies suited for military use, pushing the envelope for secure data transfer.

In terms of mergers and acquisitions, ZTE announced in August 2023 an acquisition of a subsidiary focused on military communications technology, aiming to bolster its position in this strategic sector. Moreover, China North Industries Corp and China South Industries Group have engaged in collaborative projects to integrate their defense communication systems, reflecting industry consolidation efforts.

The market valuation of companies within this sector has been positively impacted by increased government spending, estimated at over 10% growth year-on-year, driven by heightened national defense priorities. The past few years have seen a steady trajectory, especially with robust investments reported in 2022 in advanced communication infrastructure, which is crucial for modernizing the military capabilities of China.

China Military Communication Market Segmentation Insights

Military Communication Market Platform Outlook

- Airborne

- Ground Base

- Naval

Military Communication Market Type Outlook

- Satellite Communication

- Radio Communication

Military Communication Market Application Outlook

- Command & Control

- Situational Awareness

- Routine Operations

- Others

FAQs

What is the projected market size of the China Military Communication Market in 2024?

The projected market size of the China Military Communication Market in 2024 is valued at 1.79 USD Billion.

What is the expected market size of the China Military Communication Market by 2035?

The expected market size of the China Military Communication Market by 2035 is valued at 2.8 USD Billion.

What is the expected CAGR for the China Military Communication Market from 2025 to 2035?

The expected CAGR for the China Military Communication Market from 2025 to 2035 is 4.174%.

Which segment of the China Military Communication Market has the highest valuation in 2024?

The Airborne segment has the highest valuation in 2024, worth 0.72 USD Billion.

What is the anticipated growth for the Ground Base segment by 2035?

The Ground Base segment is anticipated to grow to 1.02 USD Billion by 2035.

Who are the key players in the China Military Communication Market?

Key players include China Mobile, ZTE, Huawei, and China Unicom among others.

How much is the Naval segment expected to be valued at in 2035?

The Naval segment is expected to be valued at 0.66 USD Billion by 2035.

What are the key growth drivers of the China Military Communication Market?

Key growth drivers include advancements in communication technology and increasing military expenditures.

What impact do current global scenarios have on the China Military Communication Market?

Current global scenarios are likely to drive demand for military communication solutions due to rising security concerns.

Which sub-segment in the China Military Communication Market exhibits significant growth potential?

The Airborne sub-segment exhibits significant growth potential and is valued at 1.12 USD Billion by 2035.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”