Rising Disposable Income

The growth of disposable income among the Chinese population is another significant driver for the manuka honey market. As consumers' purchasing power increases, they are more willing to invest in premium health products, including manuka honey. Market analysis suggests that the average disposable income in urban areas has increased by over 10% in recent years, enabling consumers to prioritize health and wellness. This trend is particularly evident among the middle and upper classes, who are increasingly seeking high-quality, natural products. The manuka honey market stands to gain from this demographic shift, as consumers are likely to choose premium products that align with their health goals. Additionally, the perception of manuka honey as a luxury health product may further drive its demand, as consumers associate higher prices with superior quality and efficacy.

Expansion of Retail Channels

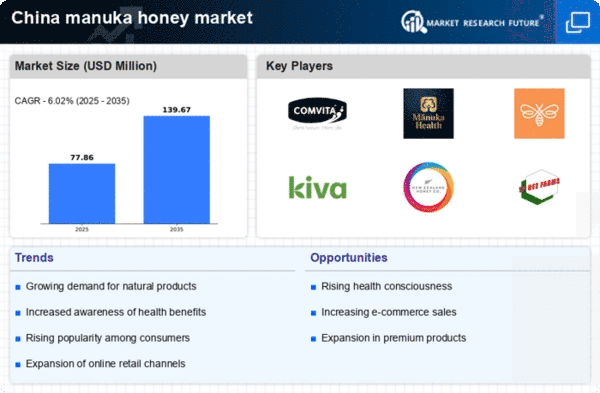

The expansion of retail channels in China is facilitating greater access to manuka honey, thereby driving market growth. Traditional retail outlets, alongside modern e-commerce platforms, are increasingly stocking manuka honey products, making them more accessible to consumers. This trend is supported by market data showing that the number of retail outlets offering health products has increased by approximately 25% over the past few years. The manuka honey market is likely to benefit from this increased availability, as consumers are more inclined to purchase products that are easily accessible. Additionally, the rise of specialty health food stores and organic markets further enhances the visibility of manuka honey, attracting a diverse consumer base. As retail channels continue to expand, the market is expected to experience sustained growth, driven by increased consumer access and awareness.

Increased Focus on Immune Health

The heightened awareness of immune health among consumers is driving interest in products that support overall well-being, including manuka honey. The manuka honey market is experiencing a boost as consumers seek natural ways to enhance their immune systems. Research indicates that manuka honey possesses unique properties that may contribute to immune support, making it an attractive option for health-conscious individuals. This trend is particularly relevant in urban areas, where consumers are increasingly prioritizing health and wellness. Market data suggests that sales of immune-boosting products have increased by around 18% in recent years, indicating a growing consumer preference for natural health solutions. As the focus on immune health continues, the demand for manuka honey is expected to rise, positioning it as a key player in the health product sector.

Growing Demand for Natural Remedies

The increasing inclination towards natural and organic products in China appears to be a pivotal driver for the manuka honey market. Consumers are becoming more aware of the health benefits associated with natural remedies, leading to a surge in demand for products like manuka honey. This trend is reflected in the market data, which indicates that the sales of natural health products have risen by approximately 15% annually. The manuka honey market is likely to benefit from this shift as consumers seek alternatives to synthetic medications, favoring products that are perceived as healthier and more effective. Furthermore, the unique antibacterial properties of manuka honey, attributed to its high methylglyoxal content, enhance its appeal among health-conscious consumers. As awareness of these benefits spreads, the market is expected to expand significantly in the coming years.

Influence of Social Media and Digital Marketing

The role of social media and digital marketing in shaping consumer preferences cannot be underestimated in the context of the manuka honey market. With the rise of platforms like WeChat and Weibo, brands are leveraging these channels to educate consumers about the benefits of manuka honey. This digital engagement appears to be effective, as market data indicates that online sales of health products have surged by approximately 20% in the past year. The manuka honey market is likely to see continued growth as brands utilize influencer marketing and targeted advertising to reach health-conscious consumers. Furthermore, the ability to share testimonials and user experiences online enhances consumer trust and encourages purchases. As digital marketing strategies evolve, they may play a crucial role in expanding the market reach of manuka honey in China.