Rising Cyber Threat Landscape

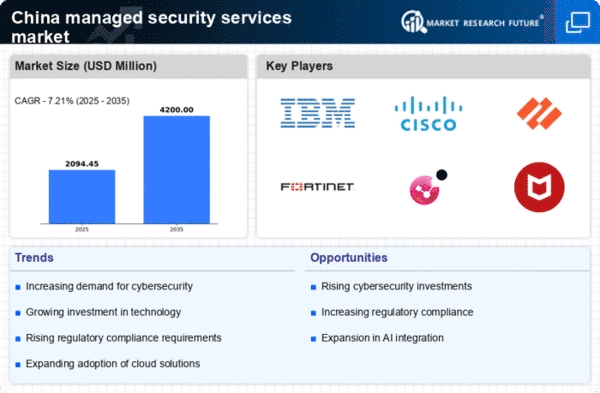

the managed security services market in China is experiencing a notable surge due to the escalating cyber threat landscape. With increasing incidents of data breaches and cyberattacks, organizations are compelled to adopt robust security measures. Reports indicate that cybercrime costs in China could reach approximately $1 trillion by 2025, highlighting the urgency for enhanced cybersecurity solutions. This environment fosters a growing reliance on managed security services, as businesses seek to mitigate risks and protect sensitive information. The managed security-services market is thus positioned to expand significantly, driven by the need for comprehensive security strategies that can adapt to evolving threats. As organizations prioritize cybersecurity, the demand for managed services is likely to increase, creating opportunities for service providers to offer tailored solutions that address specific vulnerabilities and compliance requirements.

Government Initiatives and Support

The managed security-services market in China is bolstered by proactive government initiatives aimed at enhancing national cybersecurity. The Chinese government has implemented various policies and regulations to promote cybersecurity awareness and investment in protective measures. For instance, the Cybersecurity Law, enacted in 2017, mandates organizations to adopt stringent security protocols, thereby driving demand for managed security services. Furthermore, government funding and support for cybersecurity research and development are likely to stimulate market growth. As public and private sectors collaborate to strengthen cybersecurity infrastructure, the managed security-services market is expected to benefit from increased investments and partnerships. This supportive regulatory environment encourages organizations to seek external expertise, further propelling the adoption of managed security services across various industries.

Growing Adoption of Cloud Services

The managed security-services market in China is significantly influenced by the growing adoption of cloud services. As businesses increasingly migrate to cloud-based platforms, the need for specialized security solutions becomes paramount. Cloud environments present unique vulnerabilities that necessitate comprehensive security measures, which managed security service providers are well-equipped to deliver. According to recent data, the cloud services market in China is projected to reach $20 billion by 2025, indicating a substantial opportunity for managed security services to address the associated risks. Organizations are recognizing that traditional security measures may not suffice in cloud environments, leading to a shift towards managed services that offer continuous monitoring and threat detection. This trend is likely to drive the managed security-services market as companies seek to ensure the integrity and confidentiality of their data in the cloud.

Increased Regulatory Compliance Requirements

The managed security-services market in China is experiencing growth due to heightened regulatory compliance requirements across various sectors. Organizations are increasingly required to adhere to stringent data protection laws and industry-specific regulations, which necessitate robust security frameworks. The implementation of regulations such as the Personal Information Protection Law (PIPL) has intensified the focus on data security, compelling businesses to seek external expertise in managing compliance. As organizations navigate complex regulatory landscapes, the demand for managed security services is likely to rise, as these services provide the necessary tools and knowledge to ensure compliance. This trend not only enhances the managed security-services market but also encourages organizations to adopt proactive security measures that align with regulatory expectations, thereby reducing the risk of non-compliance penalties.

Emergence of Advanced Threat Detection Technologies

The managed security-services market in China is being shaped by the emergence of advanced threat detection technologies. Innovations such as artificial intelligence (AI) and machine learning (ML) are transforming the way organizations approach cybersecurity. These technologies enable real-time threat analysis and response, significantly enhancing the effectiveness of managed security services. As businesses face increasingly sophisticated cyber threats, the integration of AI and ML into security protocols is becoming essential. The managed security-services market is likely to benefit from this trend, as service providers leverage these technologies to offer more efficient and proactive security solutions. The potential for improved threat detection and response capabilities may drive organizations to invest in managed services, thereby fostering growth in the market as they seek to stay ahead of evolving cyber threats.