Increasing Cyber Threats

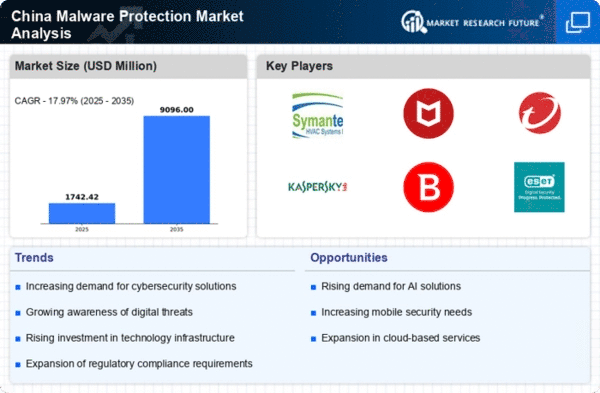

The malware protection market in China is experiencing growth due to the rising frequency and sophistication of cyber threats. Reports indicate that cybercrime incidents have surged, with a notable increase in ransomware attacks targeting both businesses and individuals. This escalation in threats has prompted organizations to invest heavily in advanced malware protection solutions. In 2025, the market is projected to reach a valuation of approximately $3 billion, reflecting a compound annual growth rate (CAGR) of around 15% over the next five years. As cybercriminals continue to evolve their tactics, the demand for robust malware protection solutions is likely to intensify, driving innovation and competition within the malware protection market.

Growing Digital Transformation

China's rapid digital transformation is significantly impacting the malware protection market. As businesses increasingly adopt cloud computing, IoT devices, and mobile applications, the attack surface for cyber threats expands. This shift necessitates comprehensive malware protection strategies to safeguard sensitive data and maintain operational integrity. In 2025, it is estimated that over 70% of enterprises in China will have migrated to cloud-based services, further amplifying the need for effective malware protection solutions. Consequently, the malware protection market is poised for substantial growth as organizations seek to mitigate risks associated with digital transformation and ensure compliance with evolving security standards.

Rising Awareness of Cybersecurity

There is a growing awareness of cybersecurity risks among Chinese consumers and businesses, which is positively influencing the malware protection market. Educational initiatives and high-profile data breaches have heightened public consciousness regarding the importance of cybersecurity. As a result, organizations are increasingly prioritizing investments in malware protection solutions to safeguard their assets. In 2025, it is projected that spending on cybersecurity in China will exceed $20 billion, with a significant portion allocated to malware protection. This trend indicates a shift in mindset, where cybersecurity is viewed as a critical component of business strategy, thereby driving demand within the malware protection market.

Regulatory Pressures and Compliance

The malware protection market in China is also being shaped by regulatory pressures and compliance requirements. The Chinese government has implemented stringent cybersecurity laws aimed at protecting personal data and critical infrastructure. Organizations are compelled to adopt robust malware protection measures to comply with these regulations, which may include regular security audits and incident reporting. As compliance becomes a priority, the malware protection market is likely to see increased demand for solutions that not only protect against malware but also facilitate adherence to regulatory standards. This trend is expected to drive innovation and the development of tailored solutions that meet specific compliance needs.

Expansion of E-commerce and Online Services

The expansion of e-commerce and online services in China is a significant driver for the malware protection market. With millions of transactions occurring daily, the potential for cyber threats targeting online platforms has escalated. E-commerce businesses are particularly vulnerable to malware attacks, which can compromise customer data and disrupt operations. As a result, there is a pressing need for effective malware protection solutions to secure online transactions and maintain consumer trust. In 2025, the e-commerce sector in China is projected to surpass $2 trillion, further underscoring the importance of robust malware protection measures. This growth trajectory indicates a promising outlook for the malware protection market as businesses seek to protect their digital assets.