E-commerce Expansion

The luxury fashion market in China is witnessing a significant transformation due to the rapid expansion of e-commerce platforms. Online sales of luxury goods have surged, accounting for nearly 30% of total luxury sales in 2025. This shift is driven by the increasing penetration of smartphones and high-speed internet, enabling consumers to shop conveniently from home. Major luxury brands are investing heavily in their online presence, optimizing their websites and leveraging social media for marketing. The luxury fashion market is adapting to this digital landscape, as brands explore innovative online strategies to engage consumers and enhance their shopping experience, ultimately driving sales growth.

Influence of Social Media

Social media platforms are playing an increasingly pivotal role in shaping consumer preferences within the luxury fashion market in China. Platforms such as WeChat and Weibo are not only facilitating brand awareness but also influencing purchasing decisions. Approximately 70% of luxury consumers in China report that social media impacts their buying choices. This trend underscores the importance of digital marketing strategies for luxury brands, as they seek to connect with younger consumers who are more likely to engage with brands online. The luxury fashion market is thus compelled to invest in social media campaigns and collaborations with influencers to enhance brand visibility and drive sales.

Rising Affluence of Consumers

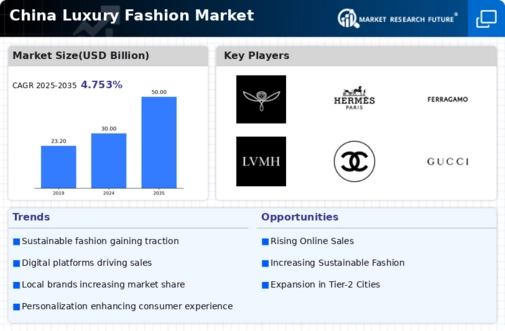

The luxury fashion market in China is experiencing a notable surge in consumer affluence, which is a critical driver of growth. As disposable incomes rise, more individuals are entering the upper-middle and high-income brackets. This demographic shift is reflected in the increasing number of households with an annual income exceeding $50,000, which has grown by approximately 20% over the past five years. Consequently, the demand for luxury goods is escalating, as consumers seek to express their status and lifestyle through high-end fashion. The luxury fashion market is thus benefiting from this trend, as brands tailor their offerings to appeal to a wealthier clientele, enhancing their market presence and profitability.

Cultural Heritage and Local Brands

The luxury fashion market in China is increasingly embracing cultural heritage, with a growing preference for local brands that reflect traditional craftsmanship. Consumers are becoming more discerning, seeking authenticity and uniqueness in their luxury purchases. This trend is evident as local luxury brands have seen a rise in market share, capturing approximately 15% of the luxury fashion market in 2025. The luxury fashion market is responding by incorporating elements of Chinese culture into their designs, appealing to national pride and consumer sentiment. This shift not only supports local artisans but also enhances the overall appeal of luxury products in the eyes of consumers.

Sustainability and Ethical Consumption

Sustainability is emerging as a crucial driver in the luxury fashion market in China, as consumers become increasingly aware of environmental issues. A recent survey indicates that over 60% of luxury consumers are willing to pay a premium for sustainable products. This growing demand is prompting luxury brands to adopt eco-friendly practices, from sourcing materials to production processes. The luxury fashion market is thus witnessing a shift towards transparency and ethical consumption, as brands strive to align with consumer values. This trend not only enhances brand loyalty but also positions companies favorably in a competitive market, as sustainability becomes a key differentiator.