Growing Mobile Data Consumption

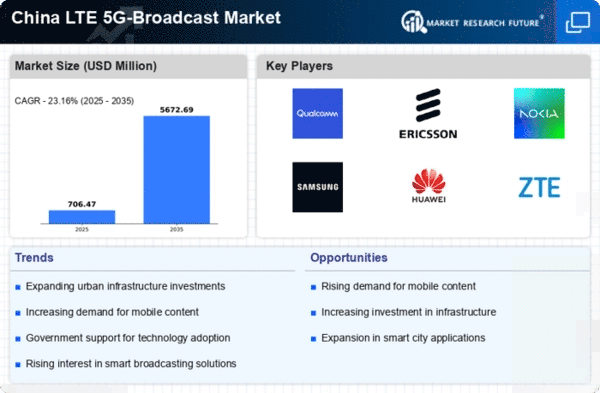

The increasing reliance on mobile devices for data consumption is a primary driver for the lte 5g-broadcast market. In China, mobile data traffic is projected to reach 50 exabytes per month by 2025, reflecting a compound annual growth rate of approximately 30%. This surge in data usage necessitates more efficient broadcasting solutions, which lte 5g-broadcast technology can provide. As consumers demand higher quality video streaming and real-time content delivery, the lte 5g-broadcast market is positioned to meet these needs. The ability to deliver high-definition content to a large audience simultaneously enhances user experience and drives market growth. Consequently, service providers are increasingly investing in lte 5g-broadcast infrastructure to capitalize on this trend, indicating a robust future for the industry.

Expansion of Smart City Initiatives

China's commitment to developing smart cities is significantly influencing the lte 5g-broadcast market. The government has allocated substantial funding, estimated at over $100 billion, to enhance urban infrastructure, which includes advanced communication networks. As smart city projects proliferate, the demand for efficient data transmission and broadcasting solutions rises. Lte 5g-broadcast technology plays a crucial role in enabling real-time data sharing among various smart city applications, such as traffic management, public safety, and environmental monitoring. This integration not only improves operational efficiency but also enhances the quality of life for residents. The lte 5g-broadcast market is thus likely to benefit from the ongoing expansion of smart city initiatives, as municipalities seek to leverage cutting-edge technology to address urban challenges.

Advancements in Content Delivery Networks

The evolution of content delivery networks (CDNs) is a critical driver for the lte 5g-broadcast market. In China, the integration of lte 5g-broadcast technology with CDNs is enhancing the efficiency of content distribution. As CDNs become more sophisticated, they are capable of delivering high-quality content to users with minimal latency. This is particularly important in an era where consumers expect instant access to information and entertainment. The collaboration between CDN providers and telecom operators is fostering innovation in broadcasting solutions, which is likely to propel the lte 5g-broadcast market forward. Furthermore, the anticipated growth of CDN revenues, projected to reach $10 billion by 2025, underscores the potential for lte 5g-broadcast technology to play a pivotal role in shaping the future of content delivery in China.

Rising Demand for Live Event Broadcasting

The lte 5g-broadcast market is significantly influenced by the growing demand for live event broadcasting in China. As the popularity of live sports, concerts, and other events continues to rise, there is an increasing need for reliable and high-quality broadcasting solutions. The ability of lte 5g-broadcast technology to deliver real-time content to large audiences enhances viewer engagement and satisfaction. Market analysts estimate that the live event broadcasting segment could account for over 25% of the total broadcasting market by 2025. This trend is prompting broadcasters and event organizers to invest in lte 5g-broadcast capabilities, ensuring that they can meet audience expectations for seamless and high-definition viewing experiences. As a result, the lte 5g-broadcast market is likely to expand in response to this growing demand.

Increased Investment in Telecommunications Infrastructure

The lte 5g-broadcast market is experiencing a surge in investment as telecommunications companies in China prioritize the expansion of their infrastructure. With the government promoting the deployment of 5G networks, investments are projected to exceed $200 billion by 2025. This financial commitment is aimed at enhancing network capabilities and coverage, which is essential for the effective implementation of lte 5g-broadcast services. As operators upgrade their networks, they are likely to adopt lte 5g-broadcast technology to improve service delivery and customer satisfaction. The competitive landscape among telecom providers further drives this investment, as companies strive to differentiate themselves through superior broadcasting capabilities. Consequently, the lte 5g-broadcast market is poised for substantial growth, fueled by these infrastructure investments.