Increased Focus on Data Privacy

Data privacy concerns are becoming increasingly prominent in the Linux operating system market in China. With the rise of data breaches and cyber threats, organizations are prioritizing secure operating systems that offer robust privacy features. Linux is often viewed as a more secure alternative to other operating systems, which enhances its appeal among businesses handling sensitive information. The market is responding to this demand, with many companies opting for linux-based solutions to safeguard their data. This shift is expected to drive growth in the linux operating-system market, with estimates suggesting a potential increase of 18% in market share over the next few years.

Rising Demand for Customization

Customization is a key driver in the Linux operating system market in China, as businesses seek tailored solutions to meet their specific needs. Unlike proprietary systems, linux offers flexibility that allows organizations to modify the software according to their operational requirements. This adaptability is particularly appealing to tech companies and startups that prioritize innovation. The market is witnessing a surge in demand for customized linux distributions, which can be optimized for performance and security. Analysts suggest that this trend could lead to a market expansion of around 20% over the next five years, as more enterprises recognize the benefits of personalized operating systems.

Government Support for Open Source

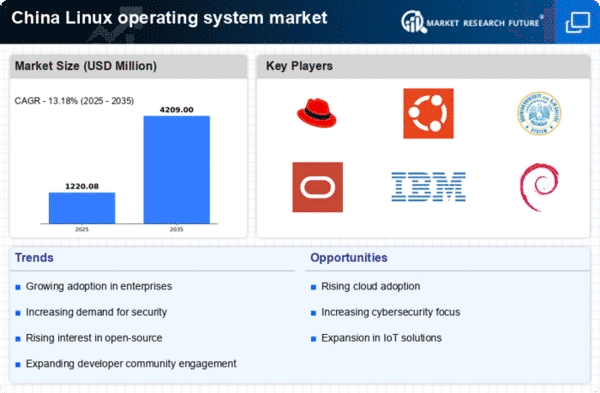

The Linux operating system market in China benefits from substantial government backing, which promotes the use of open-source software. Initiatives aimed at reducing reliance on foreign technology have led to increased investments in domestic linux distributions. The Chinese government has implemented policies that encourage the adoption of open-source solutions across various sectors, including education and public services. This support is reflected in the growing number of government-funded projects that utilize linux-based systems, which are perceived as more secure and customizable. As a result, the market is likely to see a steady increase in demand for linux operating systems, with projections indicating a growth rate of approximately 15% annually in the coming years.

Growing Interest in IoT Applications

The Linux operating system market in China is experiencing growth due to the rising interest in Internet of Things (IoT) applications. As industries explore IoT solutions for automation and data collection, the need for reliable operating systems becomes critical. Linux is favored for its stability and performance in IoT environments, which drives its adoption across various sectors, including manufacturing and smart cities. The market is likely to see a surge in demand for linux-based IoT platforms, with estimates suggesting a growth rate of approximately 22% over the next few years. This trend reflects the increasing integration of technology in everyday operations.

Expansion of Cloud Computing Services

The rapid expansion of cloud computing services in China is significantly impacting the Linux operating system market. As businesses increasingly migrate to cloud environments, the demand for reliable and scalable operating systems rises. Linux is widely recognized for its compatibility with cloud infrastructure, making it a preferred choice for cloud service providers. This trend is likely to accelerate the adoption of linux operating systems, as companies seek to leverage the benefits of cloud technology. Projections indicate that the cloud computing sector could contribute to a 25% increase in the linux operating-system market by 2027, as more organizations transition to cloud-based solutions.