Growing Aging Population

China's demographic shift towards an aging population is significantly impacting the life science-analytical-instruments market. By 2025, it is estimated that over 300 million individuals in China will be aged 60 and above, leading to an increased prevalence of chronic diseases. This demographic change necessitates advanced diagnostic and analytical tools to monitor health conditions effectively. The demand for life science-analytical instruments, such as diagnostic kits and imaging systems, is likely to rise as healthcare providers seek to improve patient outcomes. Furthermore, the government is expected to allocate more resources towards healthcare infrastructure, which will further stimulate the market. The intersection of an aging population and the need for sophisticated analytical solutions presents a compelling driver for growth in this sector.

Emergence of Precision Medicine

The emergence of precision medicine in China is reshaping the landscape of the life science-analytical-instruments market. As healthcare shifts towards personalized treatment approaches, there is a growing need for analytical instruments that can provide detailed genetic and molecular insights. By 2025, the precision medicine market in China is expected to reach $50 billion, highlighting the potential for growth in this area. Analytical tools such as next-generation sequencing and bioinformatics platforms are becoming essential for tailoring treatments to individual patients. This trend not only enhances the efficacy of medical interventions but also drives demand for sophisticated analytical instruments, thereby propelling the life science-analytical-instruments market.

Expansion of Research Institutions

The expansion of research institutions in China is a pivotal driver for the life science-analytical-instruments market. The government has been actively promoting research and development initiatives, resulting in the establishment of numerous laboratories and research centers across the country. In 2025, it is anticipated that the number of research institutions will increase by approximately 15%, fostering a conducive environment for scientific exploration. These institutions require state-of-the-art analytical instruments to conduct experiments and validate findings. Consequently, the demand for high-quality analytical tools, including spectrophotometers and electrophoresis systems, is expected to rise. This growth in research capacity not only enhances scientific output but also propels the life science-analytical-instruments market forward.

Rising Investment in Biotechnology

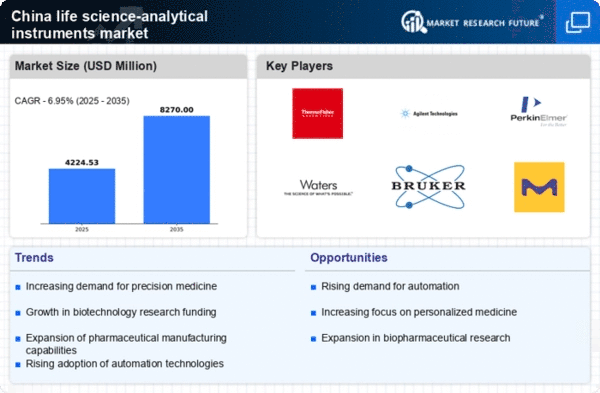

The life science-analytical-instruments market in China is experiencing a surge in investment, particularly in the biotechnology sector. This trend is driven by the increasing demand for innovative solutions in drug development and diagnostics. In 2025, the biotechnology industry in China is projected to reach a valuation of approximately $200 billion, indicating a robust growth trajectory. As a result, the demand for analytical instruments that support research and development activities is likely to escalate. Companies are investing heavily in advanced technologies such as mass spectrometry and chromatography, which are essential for high-throughput analysis. This influx of capital is expected to enhance the capabilities of laboratories and research institutions, thereby propelling the growth of the life science-analytical-instruments market.

Increased Focus on Environmental Health

The heightened awareness of environmental health issues in China is influencing the life science-analytical-instruments market. As pollution levels rise and environmental concerns grow, there is a pressing need for analytical instruments that can monitor and assess environmental contaminants. The Chinese government has implemented stricter regulations regarding environmental safety, which necessitates the use of advanced analytical techniques for compliance. By 2025, the market for environmental testing instruments is projected to grow by 20%, reflecting the increasing demand for reliable analytical solutions. This trend not only supports public health initiatives but also drives innovation within the life science-analytical-instruments market, as companies develop new technologies to meet regulatory standards.