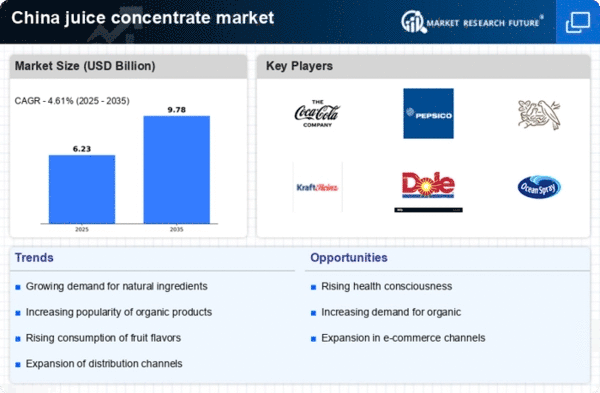

Expansion of Distribution Channels

The expansion of distribution channels significantly influences the juice concentrate market in China. Traditional retail outlets are increasingly complemented by online platforms, allowing consumers greater access to a diverse range of juice concentrate products. E-commerce sales have surged, accounting for nearly 30% of total juice concentrate sales in recent years. This shift towards online shopping is driven by convenience and the ability to compare products easily. Additionally, partnerships with supermarkets and convenience stores enhance product visibility and availability. As distribution channels continue to diversify, it is likely that the juice concentrate market will experience increased sales and market penetration, catering to a broader audience and adapting to changing consumer shopping behaviors.

Innovations in Processing Technology

Advancements in processing technology significantly impact the juice concentrate market in China. Innovations such as cold-press extraction and advanced filtration techniques enhance the quality and shelf-life of juice concentrates. These technologies allow manufacturers to retain more nutrients and flavors, appealing to a discerning consumer base. The market has seen a growth rate of approximately 8% annually, driven by these technological improvements. Furthermore, the introduction of automated production lines increases efficiency and reduces operational costs, enabling companies to scale up production. As processing technology continues to evolve, it is likely to create new opportunities for product differentiation and market expansion, thereby strengthening the overall position of the juice concentrate market.

Rising Demand for Natural Ingredients

The juice concentrate market in China experiences a notable surge in demand for natural ingredients. Consumers increasingly prefer products that are perceived as healthier and more authentic. This trend is reflected in the market, where the share of natural juice concentrates has risen to approximately 60% of total sales. The growing awareness of health benefits associated with natural ingredients drives manufacturers to innovate and offer products that align with consumer preferences. As a result, companies are investing in sourcing high-quality fruits and optimizing extraction processes to enhance the nutritional profile of their juice concentrates. This shift towards natural ingredients not only caters to health-conscious consumers but also positions the juice concentrate market as a leader in the broader beverage industry, potentially increasing market share and profitability.

Increased Focus on Health and Wellness

The juice concentrate market in China is significantly influenced by the heightened focus on health and wellness among consumers. With rising health awareness, individuals are seeking products that contribute to their overall well-being. This trend is reflected in the growing popularity of functional juice concentrates, which offer added health benefits such as vitamins, minerals, and antioxidants. Market data indicates that functional juice concentrates have seen a growth rate of approximately 12% in recent years. As consumers become more educated about nutrition, they are likely to gravitate towards products that align with their health goals. This shift presents an opportunity for manufacturers to innovate and develop new formulations that cater to the evolving preferences of health-conscious consumers, thereby enhancing the juice concentrate market's growth potential.

Growing Urbanization and Changing Lifestyles

Urbanization in China plays a crucial role in shaping the juice concentrate market. As more individuals migrate to urban areas, lifestyles evolve, leading to increased demand for convenient and ready-to-drink products. The market has observed a shift towards on-the-go consumption, with juice concentrates being favored for their portability and ease of use. This trend is further supported by the rise of modern retail channels, which facilitate access to a variety of juice concentrate products. It is estimated that urban consumers account for over 70% of juice concentrate sales, highlighting the importance of this demographic. Consequently, manufacturers are adapting their marketing strategies to target urban populations, ensuring that the juice concentrate market remains competitive and relevant in a rapidly changing environment.