Growing Cybersecurity Concerns

As the adoption of IoT technologies accelerates in China, so do the concerns regarding cybersecurity. The iot operating-systems market is increasingly influenced by the need for secure operating systems that can protect sensitive data and ensure device integrity. With cyberattacks on IoT devices rising by over 30% in recent years, manufacturers are prioritizing security features in their operating systems. This heightened focus on cybersecurity is likely to drive innovation within the market, as companies strive to develop solutions that can mitigate risks. The demand for secure operating systems is expected to contribute to a market growth rate of around 15% annually, reflecting the critical importance of security in the IoT landscape.

Rising Demand for Smart Devices

The proliferation of smart devices in China is significantly influencing the iot operating-systems market. With an estimated 1 billion smart devices expected to be in use by 2025, the demand for efficient and reliable operating systems is surging. This trend is driven by consumer preferences for connected devices that enhance convenience and efficiency in daily life. As manufacturers strive to meet this demand, they are increasingly investing in sophisticated operating systems that can support a wide range of applications. Consequently, the iot operating-systems market is likely to witness substantial growth, with projections indicating a market size reaching $5 billion by 2026, reflecting the increasing integration of IoT technologies in consumer electronics.

Government Initiatives and Support

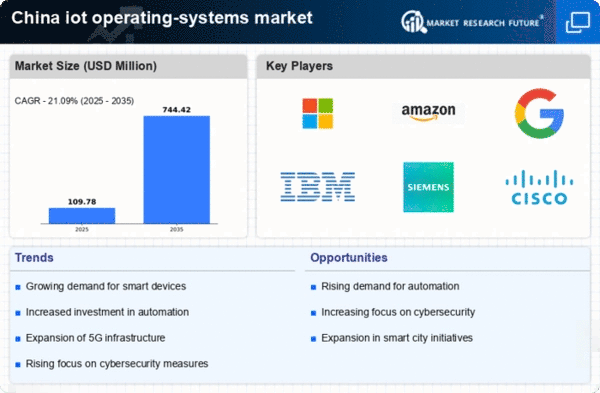

The iot operating-systems market in China is experiencing a boost due to various government initiatives aimed at promoting smart technologies. The Chinese government has allocated substantial funding, estimated at over $10 billion, to support the development of IoT infrastructure. This funding is likely to enhance research and development in the iot operating-systems market, fostering innovation and attracting investments. Furthermore, policies encouraging the adoption of IoT solutions across industries, such as manufacturing and agriculture, are expected to drive demand for advanced operating systems. As a result, the market is projected to grow at a CAGR of approximately 20% over the next five years, indicating a robust expansion fueled by governmental backing.

Advancements in Connectivity Technologies

The evolution of connectivity technologies, such as 5G, is significantly impacting the iot operating-systems market in China. The rollout of 5G networks is anticipated to enhance the performance and capabilities of IoT devices, necessitating the development of advanced operating systems that can leverage these technologies. With 5G expected to support up to 1 million devices per square kilometer, the demand for efficient operating systems that can handle increased data traffic is likely to surge. This advancement is projected to drive the market growth, with estimates suggesting a potential increase in market size to $7 billion by 2027. The integration of 5G into IoT ecosystems is thus a crucial factor influencing the future of the iot operating-systems market.

Industrial Automation and Smart Manufacturing

The push towards industrial automation in China is a key driver for the iot operating-systems market. As industries adopt smart manufacturing practices, the need for robust operating systems that can manage complex IoT networks becomes critical. The market for industrial IoT is expected to reach $30 billion by 2025, with operating systems playing a pivotal role in enabling seamless communication between devices. This shift towards automation not only enhances operational efficiency but also reduces costs, making it an attractive proposition for manufacturers. The iot operating-systems market is thus positioned to benefit from this trend, as companies seek to implement advanced systems that can support their automation goals.