Increasing Aging Population

The demographic shift in China, characterized by a rapidly increasing aging population, significantly drives the China Intraocular Lens Market. As the population aged 60 and above is projected to reach over 400 million by 2040, the prevalence of age-related eye conditions, such as cataracts, is expected to rise correspondingly. This demographic trend necessitates a greater demand for intraocular lenses, as cataract surgeries become more common. The China Intraocular Lens Market is likely to experience substantial growth as healthcare providers adapt to this demographic reality, ensuring that adequate resources and technologies are available to meet the needs of an aging populace. Furthermore, the government’s focus on improving healthcare access for the elderly may further bolster market expansion.

Rising Healthcare Expenditure

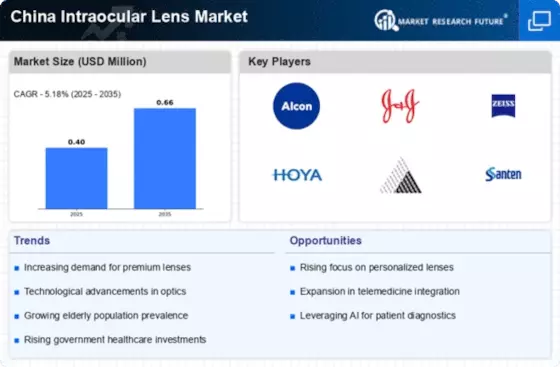

China's increasing healthcare expenditure plays a pivotal role in the growth of the China Intraocular Lens Market. With the government committing to enhance healthcare services, the total healthcare spending is projected to reach approximately 7 trillion yuan by 2025. This financial commitment is likely to facilitate the adoption of advanced medical technologies, including intraocular lenses. As hospitals and clinics invest in modern surgical equipment and techniques, the demand for high-quality intraocular lenses is expected to rise. Moreover, the expansion of health insurance coverage for cataract surgeries may further stimulate market growth, making these procedures more accessible to the general population. Consequently, the China Intraocular Lens Market stands to benefit from this upward trend in healthcare investment.

Growing Awareness of Vision Health

The growing awareness of vision health among the Chinese population is a crucial driver for the China Intraocular Lens Market. As educational campaigns and public health initiatives highlight the importance of regular eye examinations and timely treatment for vision-related issues, more individuals are seeking medical attention for cataracts and other eye conditions. This heightened awareness is likely to lead to an increase in the number of cataract surgeries performed, thereby driving demand for intraocular lenses. Additionally, the rise of social media and digital platforms has facilitated the dissemination of information regarding eye health, further encouraging proactive health-seeking behavior. Consequently, the China Intraocular Lens Market is poised for growth as more individuals prioritize their vision health.

Government Policies Supporting Eye Health

Government policies aimed at enhancing eye health significantly influence the China Intraocular Lens Market. Initiatives such as the Healthy China 2030 plan emphasize the importance of preventing and treating eye diseases, including cataracts. These policies not only promote awareness but also allocate resources for eye health programs, thereby increasing the number of cataract surgeries performed annually. The government’s commitment to improving healthcare infrastructure, particularly in rural areas, is likely to enhance access to surgical procedures and intraocular lenses. As a result, the China Intraocular Lens Market is expected to benefit from increased patient volumes and a growing emphasis on preventive care, ultimately leading to higher demand for intraocular lenses.

Technological Innovations in Lens Manufacturing

Technological advancements in lens manufacturing are transforming the China Intraocular Lens Market. Innovations such as the development of multifocal and toric lenses have enhanced surgical outcomes and patient satisfaction. The introduction of advanced materials and manufacturing techniques has led to the production of lenses that offer improved optical performance and biocompatibility. As a result, the market is witnessing a shift towards premium intraocular lenses, which are increasingly preferred by both surgeons and patients. The integration of digital technologies in lens design and production processes is also expected to streamline operations and reduce costs, thereby expanding the market. This trend indicates a promising future for the China Intraocular Lens Market as it adapts to evolving consumer preferences and technological capabilities.