Infrastructure Development

Infrastructure development plays a pivotal role in the growth of the China Hydrogen Fuel Cell Vehicle Market. The establishment of hydrogen refueling stations is essential for the widespread adoption of hydrogen fuel cell vehicles. As of January 2026, China has over 200 hydrogen refueling stations, with plans to increase this number significantly in the coming years. The government has allocated substantial funding to develop a comprehensive hydrogen infrastructure, including production, storage, and distribution facilities. This investment is expected to enhance the accessibility of hydrogen fuel, thereby encouraging consumers to transition from traditional vehicles to hydrogen fuel cell vehicles. Moreover, partnerships between public and private sectors are emerging to facilitate infrastructure expansion, which could further stimulate market growth. The ongoing development of a robust hydrogen infrastructure is likely to be a key driver in the China Hydrogen Fuel Cell Vehicle Market.

Technological Advancements

Technological advancements are a crucial driver of the China Hydrogen Fuel Cell Vehicle Market. Continuous innovation in fuel cell technology has led to improved efficiency, reduced costs, and enhanced performance of hydrogen fuel cell vehicles. Chinese manufacturers are increasingly investing in research and development to create more efficient fuel cells and hydrogen storage systems. For instance, advancements in membrane technology and catalysts have the potential to significantly lower production costs and increase the lifespan of fuel cells. Additionally, the integration of artificial intelligence and smart technologies in vehicle design is expected to enhance user experience and operational efficiency. As these technological improvements become more prevalent, they are likely to attract more consumers to hydrogen fuel cell vehicles, thereby propelling market growth in China.

Collaboration and Partnerships

Collaboration and partnerships among various stakeholders are emerging as a significant driver of the China Hydrogen Fuel Cell Vehicle Market. The complexity of developing hydrogen fuel cell technology and infrastructure necessitates cooperation between government entities, automotive manufacturers, and energy companies. Joint ventures and strategic alliances are being formed to share resources, knowledge, and expertise, which can accelerate innovation and market penetration. For example, partnerships between automotive giants and energy firms are focusing on creating integrated solutions for hydrogen production and distribution. These collaborations not only enhance technological capabilities but also facilitate the establishment of a comprehensive supply chain for hydrogen fuel cell vehicles. As these partnerships continue to evolve, they are likely to play a crucial role in shaping the future of the hydrogen fuel cell vehicle market in China.

Government Support and Policy Framework

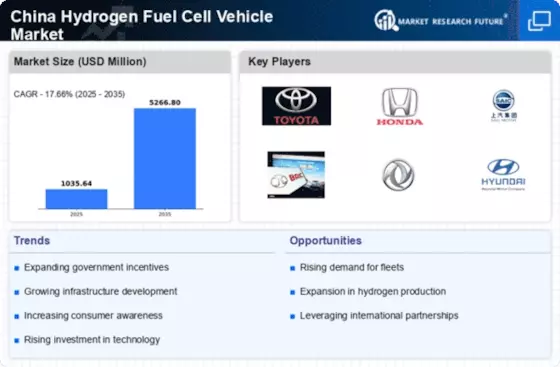

The China Hydrogen Fuel Cell Vehicle Market benefits significantly from robust government support and a comprehensive policy framework. The Chinese government has established ambitious targets for hydrogen fuel cell vehicle adoption, aiming for 1 million hydrogen fuel cell vehicles on the road by 2030. This commitment is reflected in substantial financial incentives for manufacturers and consumers, including subsidies and tax breaks. Furthermore, the government has invested heavily in research and development, fostering innovation within the industry. The National Development and Reform Commission has outlined strategic plans to enhance hydrogen production and distribution networks, which are crucial for the market's growth. As a result, the supportive policy environment is likely to accelerate the deployment of hydrogen fuel cell vehicles across China, positioning the country as a The Hydrogen Fuel Cell Vehicle.

Environmental Concerns and Sustainability

Environmental concerns and the push for sustainability are driving the China Hydrogen Fuel Cell Vehicle Market. As air pollution and climate change become increasingly pressing issues, the Chinese government is prioritizing the transition to cleaner transportation solutions. Hydrogen fuel cell vehicles produce zero tailpipe emissions, making them an attractive alternative to conventional fossil fuel-powered vehicles. The government's commitment to reducing carbon emissions by 30% by 2030 further underscores the importance of adopting hydrogen technology. Public awareness of environmental issues is also rising, leading to greater consumer interest in sustainable transportation options. This growing emphasis on sustainability is likely to encourage investments in hydrogen fuel cell technology and infrastructure, thereby fostering the growth of the market in China.