Rising Healthcare Costs

As healthcare costs continue to escalate in China, many consumers are seeking cost-effective alternatives to conventional treatments. The homeopathy market presents an appealing option for those looking to manage their health without incurring high expenses. Homeopathic remedies are often more affordable than traditional pharmaceuticals, making them accessible to a broader demographic. This shift towards cost-conscious healthcare solutions is likely to drive demand for homeopathic products, as consumers prioritize value in their health expenditures. It is estimated that the homeopathy market could grow by approximately 20% as more individuals opt for these economical alternatives.

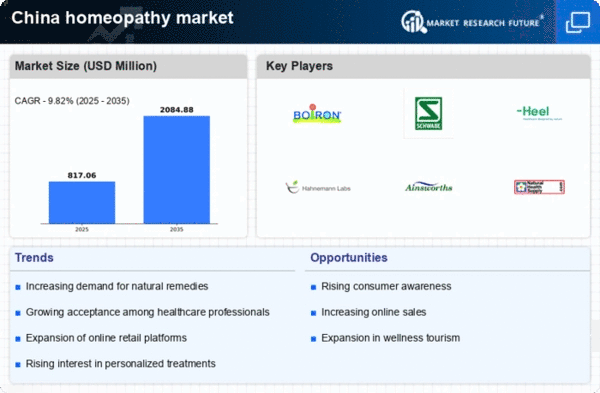

Increasing Consumer Awareness

The homeopathy market in China is experiencing a notable surge in consumer awareness regarding alternative medicine. This heightened awareness is largely attributed to the growing availability of information through digital platforms and social media. As consumers become more informed about the benefits and principles of homeopathy, they are increasingly seeking these remedies as viable options for health management. Reports indicate that approximately 30% of the population is now aware of homeopathic treatments, which is a significant increase from previous years. This trend suggests that the homeopathy market is likely to expand as more individuals explore these alternatives, potentially leading to a broader acceptance of homeopathy within the healthcare landscape.

Government Support and Regulation

The regulatory framework surrounding the homeopathy market in China is evolving, with government initiatives aimed at promoting alternative medicine. The Chinese government has recognized the importance of integrating traditional and alternative therapies into the healthcare system. Recent policies have been introduced to support the development of homeopathic practices, including funding for research and education. This regulatory support is expected to enhance the credibility of homeopathy, encouraging more practitioners to enter the field. As a result, the homeopathy market may witness growth driven by increased legitimacy and consumer trust, potentially leading to a market expansion of over 15% in the coming years.

Cultural Acceptance of Alternative Medicine

Cultural factors play a significant role in shaping the homeopathy market in China. The historical context of traditional Chinese medicine has fostered a general acceptance of alternative therapies among the population. This cultural inclination towards holistic and natural healing methods aligns well with the principles of homeopathy. As more individuals seek treatments that resonate with their cultural beliefs, the homeopathy market is poised for growth. The integration of homeopathy into the broader spectrum of traditional practices may enhance its appeal, potentially leading to an increase in market share as consumers gravitate towards familiar and culturally relevant health solutions.

Technological Advancements in Product Development

The homeopathy market is benefiting from technological advancements that facilitate the development of innovative homeopathic products. Enhanced research methodologies and production techniques are enabling manufacturers to create more effective and targeted remedies. This innovation is crucial in attracting a modern consumer base that values efficacy and quality. Furthermore, the rise of e-commerce platforms is making these products more accessible to consumers across China. As technology continues to evolve, it is likely that the homeopathy market will see an influx of new products, potentially increasing market penetration and consumer engagement.