Advancements in Display Technologies

Technological innovations in display technologies are significantly impacting the holographic communication market. The development of high-resolution displays and improved projection techniques enhances the quality of holographic images, making them more appealing for various applications. In China, the market for display technologies is expected to reach $50 billion by 2026, with a substantial portion allocated to holographic solutions. This growth is indicative of the increasing integration of holographic displays in sectors such as education, healthcare, and entertainment. The holographic communication market stands to gain from these advancements, as enhanced visual fidelity and interactivity become essential for user engagement. As display technologies continue to evolve, the potential for holographic communication applications expands, attracting further investment and interest from various sectors.

Integration with Artificial Intelligence

The integration of artificial intelligence (AI) into holographic communication systems is emerging as a pivotal driver for market growth. AI technologies can enhance the functionality of holographic systems by enabling real-time data analysis, personalized interactions, and improved user experiences. In China, the AI market is projected to reach $30 billion by 2025, suggesting a strong synergy between AI and holographic communication. This integration allows for more intuitive and responsive holographic interfaces, which could revolutionize sectors such as retail, where customer engagement is crucial. The holographic communication market is likely to see increased adoption as businesses leverage AI to create more immersive and interactive experiences, thereby enhancing the overall effectiveness of communication.

Expansion of Telecommunications Infrastructure

The expansion of telecommunications infrastructure in China is facilitating the growth of the holographic communication market. Enhanced connectivity and faster internet speeds are essential for the effective transmission of holographic data, which often requires substantial bandwidth. The Chinese government has invested heavily in upgrading its telecommunications networks, with plans to increase 5G coverage across urban and rural areas. This investment is expected to reach $100 billion by 2025, significantly improving the capabilities of holographic communication systems. As the holographic communication market benefits from these advancements, the potential for widespread adoption across various sectors, including education, healthcare, and entertainment, becomes increasingly viable. Improved infrastructure will likely enable more seamless and reliable holographic experiences, driving further interest and investment.

Growing Investment in Research and Development

Investment in research and development (R&D) within the holographic communication market is a critical driver of innovation and growth. Chinese companies are increasingly allocating resources to develop cutting-edge holographic technologies, which could lead to breakthroughs in functionality and application. The R&D expenditure in the technology sector in China is expected to exceed $400 billion by 2025, with a portion dedicated to holographic communication advancements. This focus on innovation is likely to yield new applications and improve existing technologies, thereby expanding the holographic communication market. As companies strive to maintain competitive advantages, the emphasis on R&D will play a crucial role in shaping the future landscape of holographic communication.

Rising Demand for Remote Communication Solutions

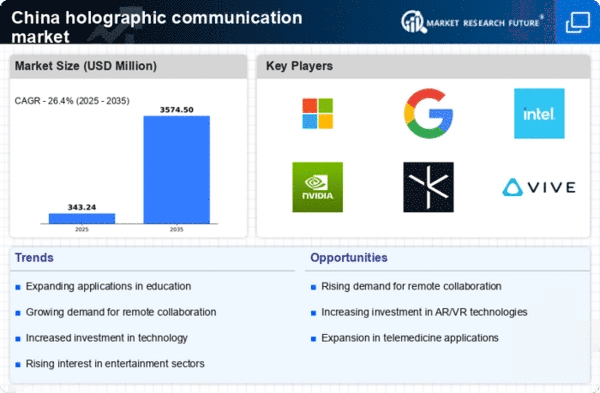

The increasing need for effective remote communication solutions is driving the growth of the holographic communication market. As businesses in China seek to enhance collaboration among geographically dispersed teams, holographic technology offers a compelling alternative to traditional video conferencing. This market is projected to grow at a CAGR of approximately 25% over the next five years, indicating a robust demand for innovative communication tools. The holographic communication market is likely to benefit from this trend, as organizations prioritize immersive experiences that foster engagement and productivity. Furthermore, the rise of remote work culture has led to a surge in investments in advanced communication technologies, positioning holographic solutions as a key player in the evolving landscape of corporate communication.