Aging Population

China's demographic shift towards an aging population is poised to have a profound impact on the heparin market. By 2025, it is projected that over 300 million individuals in China will be aged 60 and above, a demographic that typically experiences higher incidences of thromboembolic disorders. This growing elderly population is likely to require more anticoagulant therapies, including heparin, to manage their health effectively. The healthcare system is adapting to this demographic change by increasing the availability of anticoagulant treatments, which may lead to a surge in demand for heparin. Additionally, as awareness of the importance of preventive healthcare rises among older adults, the heparin market could see further growth. The intersection of an aging population and the need for effective medical interventions presents a compelling opportunity for market players.

Increasing Cardiovascular Diseases

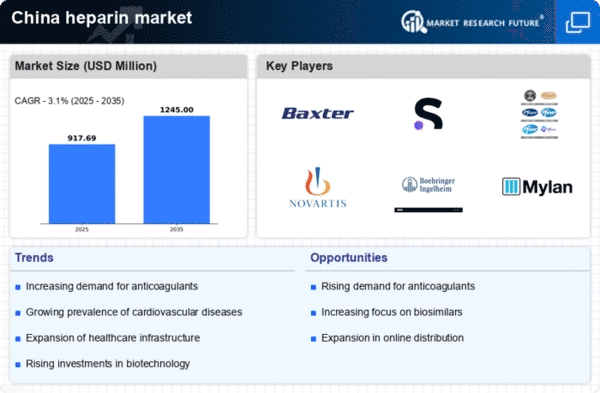

The prevalence of cardiovascular diseases in China is on the rise, which appears to be a significant driver for the heparin market. According to recent health statistics, cardiovascular diseases account for approximately 40% of all deaths in the country. This alarming trend necessitates effective anticoagulant therapies, including heparin, to manage and prevent complications associated with these conditions. As healthcare providers increasingly recognize the importance of anticoagulation therapy in treating patients with cardiovascular issues, the demand for heparin is likely to grow. Furthermore, the Chinese government has been investing in healthcare infrastructure, which may enhance access to necessary treatments, thereby further propelling the heparin market. The increasing burden of cardiovascular diseases thus serves as a critical catalyst for market expansion in this sector.

Government Initiatives and Policies

The Chinese government has been actively promoting initiatives aimed at improving healthcare access and quality, which appears to be a significant driver for the heparin market. Policies that encourage the use of anticoagulants in clinical practice are likely to enhance the adoption of heparin among healthcare providers. Additionally, the government has been working to streamline the approval processes for new drugs, which may facilitate the introduction of innovative heparin formulations into the market. With increased funding for healthcare programs and a focus on preventive care, the demand for heparin is expected to rise. These government initiatives not only support the growth of the heparin market but also aim to improve overall health outcomes for the population.

Advancements in Healthcare Technology

Technological advancements in healthcare are transforming the landscape of the heparin market in China. Innovations in drug delivery systems, such as pre-filled syringes and smart infusion pumps, are enhancing the administration of heparin, making it more efficient and patient-friendly. These advancements not only improve patient compliance but also reduce the risk of medication errors, which is crucial in anticoagulation therapy. Furthermore, the integration of digital health technologies, including telemedicine and mobile health applications, is facilitating better management of patients requiring heparin therapy. As healthcare providers increasingly adopt these technologies, the heparin market is likely to experience growth driven by improved treatment outcomes and patient satisfaction. The ongoing evolution of healthcare technology thus represents a vital driver for the market.

Rising Awareness of Thrombosis Management

There is a growing awareness of thrombosis management among healthcare professionals and patients in China, which could significantly influence the heparin market. Educational campaigns and training programs aimed at healthcare providers are enhancing their understanding of the importance of anticoagulation therapy in preventing thromboembolic events. As awareness increases, more patients are likely to be diagnosed and treated with heparin, leading to a potential rise in market demand. Furthermore, patient advocacy groups are playing a crucial role in disseminating information about the risks of thrombosis and the benefits of anticoagulant therapies. This heightened awareness may drive healthcare systems to prioritize the availability of heparin, thereby fostering growth in the heparin market.