Government Initiatives and Funding

Government initiatives aimed at improving women's health services in China are playing a crucial role in the expansion of the gynecological devices-instruments market. The Chinese government has been increasing its healthcare budget, with a focus on women's health programs. In 2025, the healthcare expenditure is projected to reach approximately $1 trillion, with a significant portion allocated to gynecological health. This funding supports the development and distribution of advanced medical devices, ensuring that healthcare facilities are equipped with the latest technology. Additionally, public health campaigns aimed at educating women about gynecological health are likely to increase the utilization of these devices, further driving market growth.

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in China is a pivotal driver for the gynecological devices-instruments market. With the government's commitment to improving healthcare access, numerous hospitals and clinics are being established, particularly in rural areas. This expansion is accompanied by investments in modern medical equipment, including gynecological devices. As of 2025, it is estimated that the number of healthcare facilities in China will increase by 15%, leading to greater availability of gynecological services. This growth in infrastructure is likely to enhance the accessibility of gynecological care, thereby increasing the demand for specialized instruments and devices. Consequently, the market is expected to experience robust growth as healthcare providers strive to meet the needs of a growing patient population.

Rising Incidence of Gynecological Disorders

The increasing prevalence of gynecological disorders in China is a significant driver for the gynecological devices-instruments market. Conditions such as endometriosis, polycystic ovary syndrome (PCOS), and uterine fibroids are becoming more common, leading to a heightened demand for diagnostic and therapeutic devices. According to recent health statistics, approximately 30% of women in reproductive age experience some form of gynecological issue, which necessitates the use of specialized instruments. This trend is likely to propel the market forward as healthcare providers seek advanced solutions to address these conditions effectively. Furthermore, the growing awareness among women regarding their reproductive health is expected to contribute to the demand for innovative gynecological devices, thereby enhancing market growth.

Technological Innovations in Medical Devices

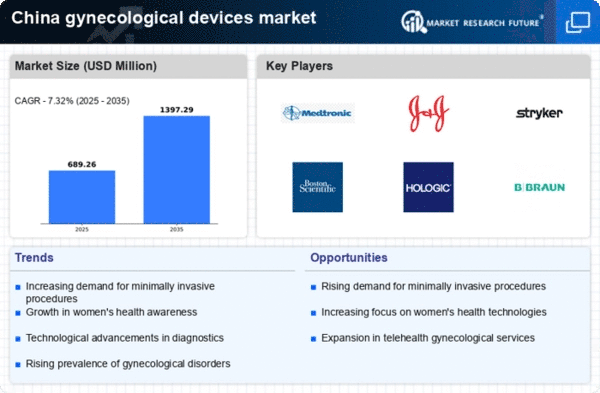

Technological advancements in medical devices are transforming the gynecological devices-instruments market in China. Innovations such as minimally invasive surgical techniques, robotic-assisted surgeries, and advanced imaging technologies are enhancing the efficacy and safety of gynecological procedures. For instance, the introduction of laparoscopic instruments has significantly reduced recovery times and complications associated with traditional surgeries. The market for these advanced devices is expected to grow at a CAGR of around 10% over the next five years, reflecting the increasing adoption of technology in healthcare. As hospitals and clinics invest in state-of-the-art equipment, the demand for innovative gynecological instruments is likely to rise, thereby propelling market growth.

Growing Awareness and Education on Women's Health

The rising awareness and education regarding women's health issues in China are driving the gynecological devices-instruments market. Educational initiatives and campaigns aimed at informing women about reproductive health, preventive care, and available treatment options are becoming more prevalent. This increased awareness is leading to higher rates of screening and early diagnosis of gynecological conditions, which in turn boosts the demand for diagnostic instruments. Reports indicate that around 60% of women are now more proactive in seeking medical advice and treatment for gynecological issues. This shift in behavior is likely to sustain the growth of the market as more women utilize gynecological devices for their health needs.