Rising Internet Penetration

The increasing internet penetration in China is a pivotal driver for the gigabit wi-fi-access-point market. As of 2025, approximately 70% of the population has access to the internet, which is expected to rise further. This surge in connectivity necessitates the deployment of advanced wi-fi technologies to accommodate the growing number of users and devices. The demand for high-speed internet is particularly pronounced in urban areas, where smart devices proliferate. Consequently, the gigabit wi-fi-access-point market is likely to experience substantial growth as consumers and businesses seek reliable and fast internet solutions. The expansion of internet services, coupled with government initiatives to enhance digital infrastructure, further propels the market forward, indicating a robust future for gigabit wi-fi-access-points in the region.

Government Initiatives and Policies

Government initiatives aimed at enhancing digital infrastructure play a crucial role in the gigabit wi-fi-access-point market. The Chinese government has implemented various policies to promote the development of high-speed internet services, including investments in broadband expansion and support for technological innovation. These initiatives are designed to bridge the digital divide and ensure that urban and rural areas alike benefit from advanced connectivity. As a result, the market for gigabit wi-fi-access-points is likely to flourish, with increased funding and resources allocated to improve network capabilities. The government's commitment to fostering a digital economy suggests that the demand for high-performance wi-fi solutions will continue to rise, thereby driving growth in the gigabit wi-fi-access-point market.

Growth of E-commerce and Online Services

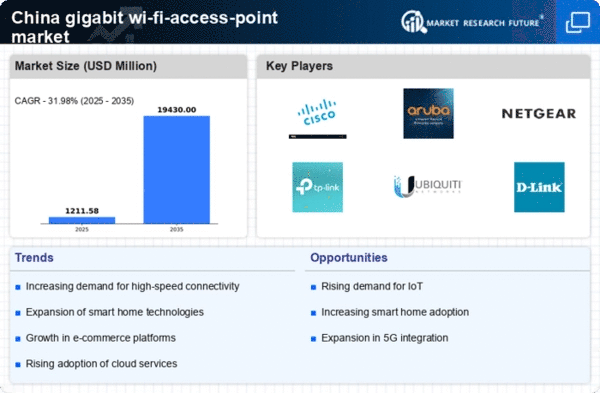

The rapid growth of e-commerce and online services in China significantly influences the gigabit wi-fi-access-point market. With e-commerce sales projected to reach over $2 trillion by 2025, businesses are increasingly reliant on high-speed internet to facilitate transactions and enhance customer experiences. This trend necessitates the deployment of gigabit wi-fi-access-points to ensure seamless connectivity for both consumers and retailers. As online shopping becomes more prevalent, the demand for robust wi-fi solutions is expected to escalate, driving market growth. Additionally, the rise of digital payment systems and online streaming services further underscores the need for reliable and fast internet access, positioning the gigabit wi-fi-access-point market as a critical component of the evolving digital landscape.

Increased Adoption of Smart Technologies

The growing adoption of smart technologies in various sectors is a significant driver for the gigabit wi-fi-access-point market. As smart homes and smart cities gain traction in China, the demand for high-speed connectivity becomes paramount. Devices such as smart thermostats, security systems, and home automation tools require reliable internet access to function optimally. This trend is likely to propel the gigabit wi-fi-access-point market, as consumers seek solutions that can support multiple devices simultaneously without compromising performance. Furthermore, the integration of smart technologies in industries such as healthcare and manufacturing highlights the necessity for advanced wi-fi infrastructure, suggesting a promising outlook for the market as it adapts to these evolving needs.

Rising Consumer Expectations for Connectivity

Consumer expectations for connectivity are evolving, driving demand in the gigabit wi-fi-access-point market. As users become more accustomed to high-speed internet, they increasingly expect seamless connectivity across all devices. This shift in consumer behavior is particularly evident in urban areas, where the proliferation of smart devices necessitates robust wi-fi solutions. The gigabit wi-fi-access-point market is likely to benefit from this trend, as manufacturers strive to meet the growing demand for faster and more reliable internet access. Additionally, the rise of remote work and online education has heightened the need for dependable connectivity, further propelling market growth. As consumers continue to prioritize high-performance wi-fi solutions, the market is expected to expand in response to these changing expectations.