Rise of Indie Game Development

The game api market in China is experiencing a rise in indie game development, which is reshaping the landscape of the gaming industry. With the advent of accessible development tools and platforms, independent developers are increasingly creating innovative games that cater to niche audiences. This trend is reflected in the growing number of indie titles released annually, which has increased by approximately 25% over the past few years. As indie developers seek to differentiate their offerings, the demand for specialized game APIs that support unique gameplay mechanics and artistic styles is likely to grow. Furthermore, the success of indie games often hinges on community engagement and feedback, prompting developers to utilize APIs that facilitate player interaction and content sharing. Consequently, the game API market is poised for expansion as it adapts to the needs of the burgeoning indie development scene in China.

Surge in Mobile Gaming Popularity

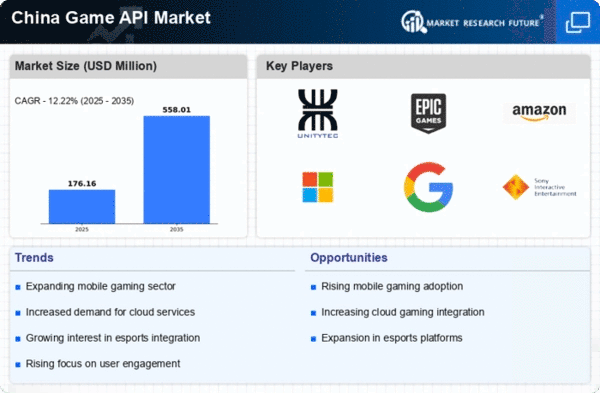

The game api market in China experiences a notable surge in mobile gaming popularity, driven by the increasing penetration of smartphones and mobile internet. As of 2025, mobile gaming accounts for approximately 70% of the total gaming revenue in the country, indicating a shift in consumer preferences towards mobile platforms. This trend compels developers to integrate robust APIs that facilitate seamless gameplay experiences across various devices. The demand for mobile-optimized game APIs is likely to grow, as developers seek to enhance user engagement and retention. Furthermore, the rise of mobile esports and competitive gaming events further fuels the need for sophisticated game APIs that can support real-time interactions and high-performance gaming environments. Consequently, the game API market is poised for substantial growth as developers adapt to the evolving landscape of mobile gaming in China.

Expansion of Cloud Gaming Services

The game api market in China is significantly influenced by the expansion of cloud gaming services, which have gained traction among gamers seeking high-quality experiences without the need for expensive hardware. As of November 2025, the cloud gaming sector is projected to reach a valuation of $5 billion, reflecting a growing consumer base that prefers streaming games over traditional downloads. This shift necessitates the development of advanced game APIs that can support low-latency streaming and high-definition graphics. Developers are increasingly focusing on creating APIs that optimize performance and ensure compatibility with various cloud platforms. The rise of cloud gaming not only enhances accessibility for players but also encourages developers to innovate and create more engaging content. As a result, the game API market is likely to see increased investment and innovation in API solutions tailored for cloud gaming environments.

Integration of Social Features in Gaming

The game api market in China is witnessing a trend towards the integration of social features within gaming experiences. As players increasingly seek social interactions while gaming, developers are compelled to incorporate APIs that facilitate social connectivity, such as friend lists, chat functionalities, and multiplayer capabilities. Recent studies indicate that games with social features can enhance player retention by up to 30%, highlighting the importance of these functionalities in modern game design. This trend is particularly relevant in the context of mobile and online gaming, where social interactions can significantly influence user engagement. Consequently, the demand for game APIs that support social features is expected to rise, prompting developers to prioritize these integrations in their offerings. the game API market is evolving to accommodate the growing need for social connectivity among gamers in China.

Regulatory Changes and Compliance Requirements

The game api market in China is increasingly shaped by regulatory changes and compliance requirements imposed by the government. As authorities implement stricter regulations regarding content, data privacy, and user protection, developers must adapt their APIs to ensure compliance. This evolving regulatory landscape necessitates the integration of features that facilitate age verification, content moderation, and data security. As of November 2025, it is estimated that compliance-related costs could account for up to 15% of a developer's budget, underscoring the financial implications of adhering to these regulations. Developers are likely to seek game APIs that offer built-in compliance features, enabling them to navigate the complex regulatory environment more efficiently. Thus, the game API market is expected to grow driven by the demand for compliant solutions that align with government standards.