Increased Investment in R&D

Investment in research and development (R&D) within the Food Antioxidants Market is gaining momentum in China. Companies are increasingly allocating resources to explore new sources of antioxidants and develop innovative formulations that enhance product efficacy. This trend is supported by government initiatives aimed at promoting food safety and quality, which encourage the exploration of natural antioxidants derived from local agricultural products. The food antioxidants market is likely to benefit from these advancements, as R&D efforts may lead to the discovery of novel antioxidant compounds that can be effectively utilized in food preservation and health enhancement. As a result, the market is expected to witness a surge in product offerings that leverage these scientific advancements.

Growing Health Consciousness

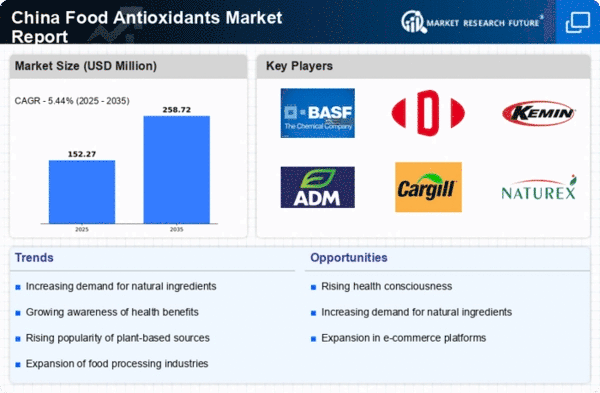

The increasing awareness of health and wellness among consumers in China appears to be a primary driver for the Food Antioxidants Market. As individuals become more informed about the benefits of antioxidants in combating oxidative stress and chronic diseases, the demand for antioxidant-rich food products is likely to rise. This trend is reflected in market data, indicating that the food antioxidants market is projected to grow at a CAGR of approximately 8% from 2025 to 2030. Consumers are actively seeking natural sources of antioxidants, such as fruits, vegetables, and herbal extracts, which are perceived as healthier alternatives to synthetic additives. Consequently, manufacturers are responding by reformulating products to include these natural ingredients, thereby enhancing their market appeal and aligning with consumer preferences.

Expansion of Functional Foods

The Food Antioxidants Market is experiencing a notable expansion due to the rising popularity of functional foods in China. These products, which are fortified with beneficial ingredients, including antioxidants, are increasingly being embraced by health-conscious consumers. The market for functional foods is expected to reach approximately $100 billion by 2026, indicating a robust growth trajectory. This trend is driven by the desire for foods that not only provide basic nutrition but also offer additional health benefits, such as improved immunity and enhanced longevity. As a result, food manufacturers are innovating to incorporate antioxidants into their offerings, thereby catering to the evolving demands of consumers who prioritize health and wellness in their dietary choices.

Rising Incidence of Chronic Diseases

The escalating prevalence of chronic diseases in China, such as diabetes and cardiovascular conditions, is driving the demand for the Food Antioxidants Market. Antioxidants are recognized for their potential role in mitigating oxidative stress, which is linked to the development of these diseases. As healthcare costs continue to rise, consumers are increasingly turning to dietary solutions that may help prevent or manage these health issues. This shift in consumer behavior is reflected in market trends, with a projected increase in the consumption of antioxidant-rich foods. The food antioxidants market is thus positioned to grow as individuals seek to incorporate more functional ingredients into their diets to support overall health and well-being.

Influence of Social Media and Marketing

The role of social media and digital marketing in shaping consumer perceptions and preferences is becoming increasingly significant in the Food Antioxidants Market. In China, platforms such as WeChat and Weibo are utilized by brands to promote the health benefits of antioxidants, thereby influencing purchasing decisions. This digital engagement appears to be effective in reaching younger demographics who are more inclined to seek out health-oriented products. As a result, companies are investing in targeted marketing campaigns that highlight the advantages of antioxidants, which may lead to increased sales and market penetration. The food antioxidants market is likely to benefit from this trend as brands leverage social media to educate consumers and drive demand.