The competitive dynamics within the fifth party logistics market in China are characterized by rapid evolution and a diverse array of strategic initiatives. Key growth drivers include the increasing demand for integrated logistics solutions, the rise of e-commerce, and the necessity for enhanced supply chain efficiency. Major players such as JD Logistics (CN), SF Express (CN), and Cainiao Network (CN) are at the forefront, each adopting distinct strategies to solidify their market positions. JD Logistics (CN) emphasizes technological innovation and automation, while SF Express (CN) focuses on expanding its service offerings through strategic partnerships. Cainiao Network (CN), on the other hand, leverages its extensive data analytics capabilities to optimize logistics operations, thereby enhancing customer experience and operational efficiency. Collectively, these strategies contribute to a competitive environment that is increasingly driven by technological advancements and customer-centric solutions.

In terms of business tactics, localization of services and supply chain optimization are paramount. The market structure appears moderately fragmented, with several key players vying for dominance. This fragmentation allows for a variety of service offerings, catering to different segments of the market. The collective influence of these major companies shapes the competitive landscape, as they continuously adapt to changing consumer demands and technological advancements.

In December 2025, JD Logistics (CN) announced a significant investment in AI-driven logistics solutions aimed at enhancing operational efficiency. This strategic move is likely to bolster its competitive edge by streamlining processes and reducing delivery times, thereby meeting the growing expectations of e-commerce consumers. The integration of AI technologies may also facilitate better inventory management and predictive analytics, further solidifying JD Logistics' position in the market.

In November 2025, SF Express (CN) expanded its partnership with local manufacturers to enhance its last-mile delivery capabilities. This initiative is strategically important as it allows SF Express to tap into localized supply chains, thereby improving delivery speed and reducing costs. By fostering closer relationships with manufacturers, SF Express is likely to enhance its service reliability and customer satisfaction, which are critical in the highly competitive logistics sector.

In October 2025, Cainiao Network (CN) launched a new data analytics platform designed to optimize logistics operations for small and medium-sized enterprises (SMEs). This platform is expected to empower SMEs by providing them with advanced tools to manage their logistics more effectively. The strategic importance of this initiative lies in its potential to democratize access to sophisticated logistics solutions, thereby expanding Cainiao's customer base and reinforcing its market leadership.

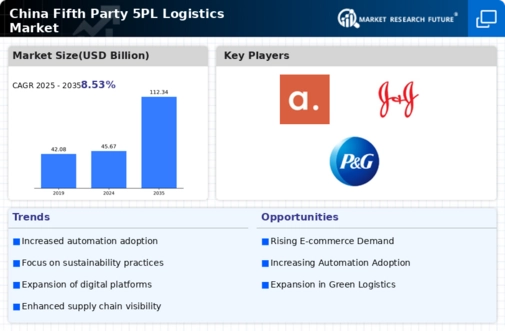

As of January 2026, current trends in the fifth party logistics market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing service offerings. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, supply chain reliability, and sustainability initiatives. This shift suggests that companies that prioritize these aspects will be better positioned to thrive in the dynamic logistics environment.