Government Initiatives and Support

The Chinese government plays a pivotal role in fostering the growth of the field service-management market through various initiatives and support programs. Policies aimed at promoting digital transformation and smart manufacturing are encouraging businesses to invest in advanced field service solutions. The government's focus on enhancing infrastructure and technology adoption is likely to create a conducive environment for market expansion. In recent years, funding and incentives have been allocated to support companies in upgrading their service management capabilities. This proactive approach is expected to drive the field service-management market forward, as organizations align with national objectives to improve service efficiency and customer satisfaction.

Shift Towards Cloud-Based Solutions

The transition to cloud-based solutions is reshaping the field service management market in China. Organizations are increasingly adopting cloud technologies to enhance flexibility, scalability, and accessibility of their service management systems. This shift allows for real-time data sharing and collaboration among field technicians, leading to improved service delivery and operational efficiency. In 2025, it is projected that cloud-based solutions will account for over 50% of the market share, reflecting a significant trend towards digital transformation. The ability to access service management tools from anywhere is empowering businesses to respond swiftly to customer needs, thereby enhancing overall service quality in the field service-management market.

Rising Demand for Efficient Operations

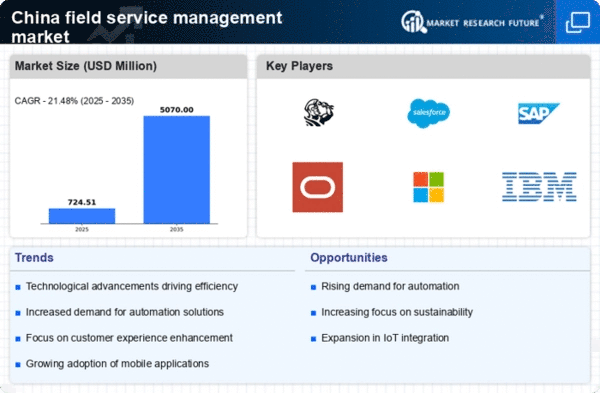

The field service management market in China experiences a notable surge in demand for operational efficiency. Companies are increasingly seeking solutions that streamline processes, reduce costs, and enhance service delivery. This trend is driven by the competitive landscape, where businesses strive to differentiate themselves through superior customer service. In 2025, the market is projected to grow at a CAGR of approximately 12%, reflecting the urgency for organizations to adopt advanced field service solutions. The integration of automation and real-time tracking systems is becoming essential for optimizing resource allocation and improving response times. As a result, the field service-management market is witnessing a shift towards more sophisticated technologies that facilitate seamless operations and enhance overall productivity.

Growing Emphasis on Customer Experience

In the competitive landscape of the field service-management market, there is a growing emphasis on enhancing customer experience. Companies are recognizing that exceptional service can be a key differentiator in attracting and retaining clients. As a result, organizations are investing in technologies that enable personalized service and timely communication. The integration of customer feedback mechanisms and service analytics is becoming commonplace, allowing businesses to tailor their offerings to meet specific client needs. This focus on customer-centric strategies is likely to drive growth in the field service-management market, as companies strive to build long-term relationships and foster loyalty among their customer base.

Increasing Adoption of IoT Technologies

The proliferation of Internet of Things (IoT) technologies significantly impacts the field service-management market in China. As more devices become interconnected, businesses are leveraging IoT to enhance service delivery and operational efficiency. The ability to collect and analyze real-time data from equipment and assets allows companies to predict maintenance needs and reduce downtime. In 2025, it is estimated that the adoption of IoT solutions in the field service sector could lead to a 20% increase in service efficiency. This trend indicates a shift towards proactive service models, where organizations can anticipate issues before they escalate, thereby improving customer satisfaction and loyalty within the field service-management market.