Enhanced Cybersecurity Measures

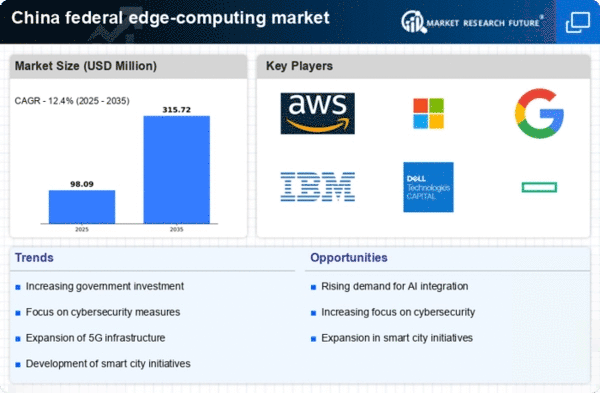

As cyber threats continue to evolve, the need for enhanced cybersecurity measures is a pivotal driver in the federal edge-computing market. Chinese government agencies are increasingly prioritizing data protection and privacy, leading to a surge in demand for edge computing solutions that can provide localized security. By processing sensitive data at the edge, agencies can minimize exposure to potential breaches. The federal edge-computing market is likely to see a rise in investments aimed at developing robust security protocols, with projections indicating a market growth of around 20% in cybersecurity-related edge solutions. This focus on security not only protects critical infrastructure but also builds public trust in government digital services.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into edge computing systems is emerging as a significant driver in the federal edge-computing market. AI technologies enable more efficient data processing and analysis at the edge, allowing government agencies to leverage insights for better decision-making. In China, the government has recognized the potential of AI to enhance public services, leading to increased investments in AI-driven edge solutions. By 2025, it is anticipated that AI applications in edge computing will account for a substantial portion of the market, potentially reaching a valuation of $10 billion. This integration not only improves operational efficiency but also supports innovative applications in areas such as healthcare, transportation, and public safety.

Focus on Sustainable Technology Solutions

The growing emphasis on sustainability is influencing the federal edge-computing market in China. Government policies are increasingly advocating for environmentally friendly technology solutions, prompting agencies to adopt edge computing systems that reduce energy consumption and carbon footprints. By processing data closer to the source, edge computing minimizes the need for extensive data transmission, thereby conserving energy. This trend aligns with China's broader environmental goals, which aim to achieve carbon neutrality by 2060. As a result, the federal edge-computing market is likely to experience a shift towards sustainable practices, with investments in energy-efficient technologies expected to rise significantly, potentially leading to a market growth of 15% in sustainable edge solutions.

Rising Demand for Real-Time Data Processing

The increasing need for real-time data processing is a crucial driver in the federal edge-computing market. As government agencies in China seek to enhance operational efficiency, the demand for immediate data analysis and decision-making capabilities has surged. This trend is particularly evident in sectors such as public safety and transportation, where timely information can significantly impact outcomes. Reports indicate that the market for edge computing solutions is expected to grow at a CAGR of approximately 25% over the next five years, reflecting the urgency for faster data processing. Consequently, the federal edge-computing market is positioned to expand as agencies invest in technologies that facilitate real-time analytics, thereby improving service delivery and operational responsiveness.

Government Initiatives for Smart City Development

China's ambitious smart city initiatives are driving the federal edge-computing market forward. The government has allocated substantial funding to develop smart infrastructure, which relies heavily on edge computing to process data locally and reduce latency. By 2025, it is projected that over 100 cities will implement smart city technologies, creating a robust demand for edge computing solutions. These initiatives aim to enhance urban management, improve public services, and optimize resource allocation. The federal edge-computing market stands to benefit significantly as local governments adopt these technologies to support smart traffic systems, energy management, and public safety applications, thereby fostering a more efficient urban environment.