Rising Cybersecurity Threats

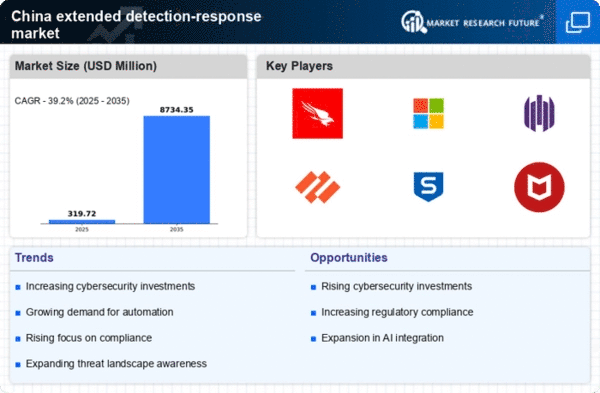

The increasing frequency and sophistication of cyber threats in China is a primary driver for the extended detection-response market. As organizations face advanced persistent threats and ransomware attacks, the demand for comprehensive security solutions escalates. In 2025, it is estimated that cybercrime could cost the Chinese economy over $1 trillion, prompting businesses to invest in advanced detection and response capabilities. The extended detection-response market industry is witnessing a surge in demand as companies seek to enhance their security posture and mitigate risks associated with data breaches. This trend is likely to continue as the digital landscape evolves, necessitating robust security measures to protect sensitive information and maintain customer trust.

Emergence of Advanced Technologies

The rapid advancement of technologies such as artificial intelligence, machine learning, and automation is reshaping the extended detection-response market in China. These technologies enable organizations to enhance their threat detection and response capabilities, making security operations more efficient and effective. In 2025, it is projected that AI-driven security solutions will account for over 30% of the extended detection-response market industry. This shift indicates a growing reliance on innovative technologies to combat sophisticated cyber threats. As organizations increasingly adopt these advanced solutions, the market is likely to experience significant growth, driven by the demand for proactive and adaptive security measures.

Government Initiatives and Support

The Chinese government is actively promoting cybersecurity initiatives, which significantly impacts the extended detection-response market. Policies aimed at enhancing national security and protecting critical infrastructure are driving investments in advanced security technologies. In 2025, government funding for cybersecurity is projected to reach approximately $10 billion, fostering innovation and development within the extended detection-response market industry. This support encourages organizations to adopt sophisticated security solutions, thereby increasing market growth. Furthermore, compliance with national cybersecurity standards is becoming mandatory, compelling businesses to invest in extended detection-response capabilities to align with regulatory requirements.

Increased Awareness of Data Privacy

Growing concerns regarding data privacy and protection are influencing the extended detection-response market in China. With the implementation of stricter data protection laws, organizations are compelled to prioritize security measures to safeguard personal information. In 2025, it is expected that compliance costs related to data privacy regulations will rise significantly, prompting businesses to invest in advanced detection and response technologies. The extended detection-response market industry is likely to benefit from this heightened awareness, as companies seek solutions that not only protect against breaches but also ensure compliance with evolving legal frameworks. This trend underscores the importance of integrating privacy considerations into security strategies.

Digital Transformation and Remote Work

The ongoing digital transformation across various sectors in China is a crucial driver for the extended detection-response market. As organizations increasingly adopt digital tools and remote work practices, the attack surface expands, leading to heightened security vulnerabilities. In 2025, it is anticipated that over 60% of Chinese companies will have implemented remote work policies, necessitating enhanced security measures. The extended detection-response market industry is responding to this shift by offering solutions that provide visibility and control over diverse environments. This trend indicates a growing recognition of the need for integrated security solutions that can effectively address the complexities of modern work arrangements.