Increased Focus on Employee Engagement

In the China enterprise collaboration market, there is a growing emphasis on employee engagement as organizations strive to enhance workplace culture and productivity. Research indicates that companies with high employee engagement levels experience a 20% increase in productivity. As a response, businesses are increasingly investing in collaboration tools that foster communication, teamwork, and feedback. These tools not only facilitate real-time collaboration but also enable organizations to gather insights on employee satisfaction and performance. This trend is likely to drive the demand for advanced collaboration solutions that prioritize user experience and engagement, positioning the China enterprise collaboration market for sustained growth.

Growing Demand for Remote Work Solutions

The China enterprise collaboration market is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for effective collaboration tools has become paramount. According to recent statistics, over 70% of companies in China have implemented remote work policies, driving the adoption of platforms that facilitate seamless communication and project management. This trend is likely to continue, as businesses recognize the benefits of remote work in enhancing productivity and employee satisfaction. Consequently, vendors in the China enterprise collaboration market are focusing on developing innovative solutions that cater to the unique needs of remote teams, thereby fostering a more connected and efficient workforce.

Rise of Cloud-Based Collaboration Platforms

The shift towards cloud-based collaboration platforms is a defining trend in the China enterprise collaboration market. With the increasing adoption of cloud technology, organizations are seeking scalable and flexible solutions that can accommodate their collaboration needs. Data suggests that the cloud collaboration market in China is projected to reach USD 10 billion by 2026, reflecting a robust growth trajectory. This shift is driven by the advantages of cloud solutions, such as cost-effectiveness, accessibility, and enhanced security features. As businesses continue to migrate to the cloud, the demand for integrated collaboration tools that support remote work and cross-functional teams is expected to rise, further propelling the growth of the China enterprise collaboration market.

Emergence of Industry-Specific Collaboration Tools

The China enterprise collaboration market is witnessing the emergence of industry-specific collaboration tools tailored to meet the unique needs of various sectors. As organizations recognize that one-size-fits-all solutions may not suffice, there is a growing demand for specialized platforms that address specific challenges within industries such as healthcare, finance, and manufacturing. For instance, collaboration tools designed for the healthcare sector focus on secure communication and compliance with regulations, while those in finance emphasize data security and real-time analytics. This trend indicates a shift towards more customized solutions, which could enhance operational efficiency and collaboration effectiveness across different industries, thereby driving growth in the China enterprise collaboration market.

Government Initiatives Supporting Digital Transformation

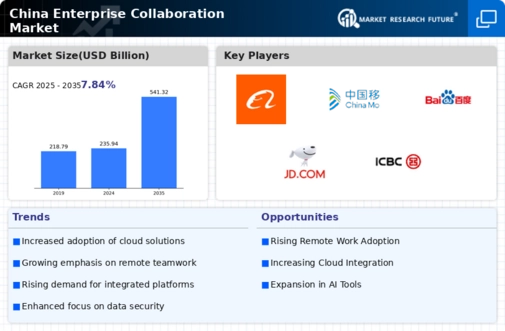

The Chinese government has been actively promoting digital transformation across various sectors, which significantly impacts the China enterprise collaboration market. Initiatives such as the 'Digital China' strategy aim to enhance the integration of digital technologies in business operations. This policy framework encourages organizations to adopt advanced collaboration tools, thereby streamlining processes and improving overall efficiency. As a result, investments in enterprise collaboration solutions are expected to rise, with projections indicating a compound annual growth rate of over 15% in the coming years. The government's support for digital infrastructure development further bolsters the growth of the China enterprise collaboration market, creating a conducive environment for innovation and technological advancement.