Growing Health Consciousness

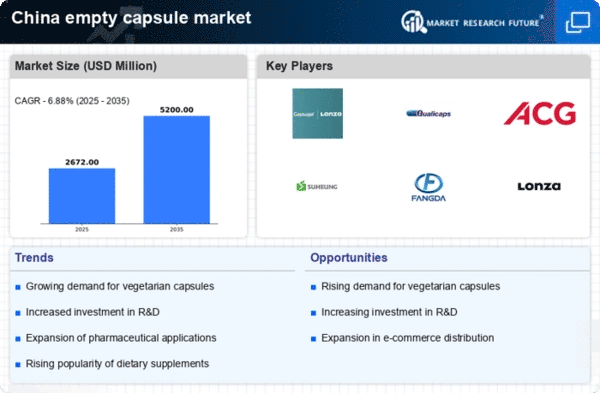

The increasing awareness of health and wellness among consumers in China appears to be a significant driver for the empty capsule market. As individuals become more health-conscious, there is a rising demand for dietary supplements and herbal products, which often utilize empty capsules for delivery. This trend is reflected in the market data, indicating that the dietary supplement sector in China is projected to grow at a CAGR of approximately 10% over the next five years. Consequently, the empty capsule market is likely to benefit from this surge in demand, as manufacturers strive to meet the needs of health-oriented consumers seeking convenient and effective supplement options.

Expansion of Pharmaceutical Sector

The rapid expansion of the pharmaceutical sector in China is a crucial factor influencing the empty capsule market. With the government's focus on enhancing healthcare infrastructure and increasing investment in pharmaceutical research and development, the demand for empty capsules is expected to rise. Recent statistics suggest that the pharmaceutical market in China is anticipated to reach $150 billion by 2025. This growth is likely to drive the empty capsule market, as pharmaceutical companies increasingly adopt capsule formulations for their products, favoring them for their ease of use and patient compliance.

Regulatory Changes Favoring Capsule Use

Recent regulatory changes in China appear to favor the use of empty capsules in various applications, including pharmaceuticals and nutraceuticals. The government is implementing policies that encourage the adoption of innovative drug delivery systems, which may include the use of capsules. This regulatory support is likely to stimulate growth in the empty capsule market, as manufacturers align their products with new guidelines and standards. The potential for streamlined approval processes for capsule-based products may further enhance market dynamics, encouraging more companies to enter the empty capsule market.

Rising Popularity of Personalized Medicine

The trend towards personalized medicine in China is emerging as a notable driver for the empty capsule market. As healthcare providers and patients seek tailored treatment options, the demand for customized supplements and medications is increasing. This shift is likely to encourage manufacturers in the empty capsule market to innovate and produce capsules that can accommodate specific formulations. The potential for personalized medicine to enhance treatment efficacy may lead to a greater reliance on empty capsules, as they offer flexibility in dosage and formulation, aligning with the growing trend of individualized healthcare solutions.

Increased Investment in Research and Development

Investment in research and development within the empty capsule market is gaining momentum in China. Companies are focusing on developing advanced capsule technologies, such as enteric-coated and sustained-release capsules, to meet diverse consumer needs. This emphasis on innovation is likely to enhance product offerings and improve the overall quality of empty capsules. Market data indicates that R&D spending in the pharmaceutical sector is expected to increase by 15% annually, which may positively impact the empty capsule market as companies strive to create more effective and specialized products.