Rising Industrial Automation

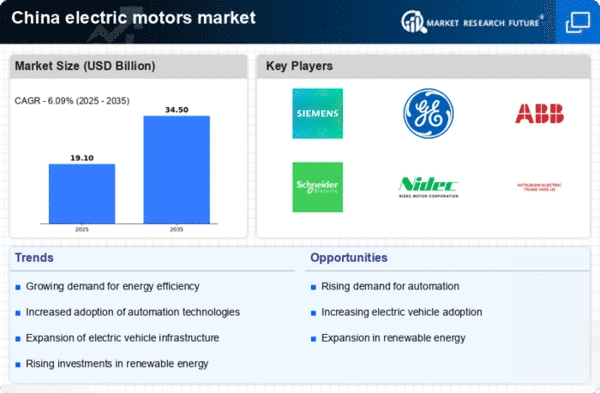

The electric motors market in China is experiencing a notable surge due to the increasing trend of industrial automation. As industries strive for enhanced efficiency and productivity, the demand for electric motors is expected to rise significantly. In 2025, the market is projected to reach approximately $20 billion, driven by sectors such as manufacturing, logistics, and automotive. Automation technologies, including robotics and conveyor systems, heavily rely on electric motors for operation. This reliance indicates a robust growth trajectory for the electric motors market, as companies invest in advanced machinery to streamline operations and reduce labor costs. Furthermore, the Chinese government's initiatives to promote smart manufacturing and Industry 4.0 are likely to further bolster the demand for electric motors, making this a critical driver in the market.

Growth in Renewable Energy Sector

The electric motors market is poised for growth due to the increasing investments in the renewable energy sector in China. As the country aims to transition towards cleaner energy sources, the demand for electric motors in applications such as wind turbines and solar energy systems is expected to rise. By 2025, it is projected that the renewable energy sector will account for approximately 25% of the electric motors market. This growth is driven by government policies promoting renewable energy adoption and the need for efficient energy conversion systems. Electric motors play a crucial role in the operation of renewable energy technologies, making them indispensable in this evolving landscape. As the shift towards sustainability continues, the electric motors market is likely to benefit from the expanding renewable energy initiatives, positioning it as a key driver of market dynamics.

Expansion of Electric Vehicle Market

The electric motors market is significantly influenced by the rapid expansion of the electric vehicle (EV) market in China. As one of the largest markets for electric vehicles, China is witnessing a substantial increase in demand for electric motors, which are essential components in EVs. In 2025, the electric vehicle segment is projected to account for approximately 30% of the total electric motors market. This growth is driven by consumer preferences for sustainable transportation solutions and government incentives promoting EV adoption. Furthermore, advancements in battery technology and charging infrastructure are likely to enhance the performance and appeal of electric vehicles, further propelling the demand for electric motors. Consequently, the electric motors market is poised to benefit from this burgeoning sector, making it a vital driver of growth.

Government Initiatives and Regulations

Government policies and regulations play a pivotal role in shaping the electric motors market in China. The Chinese government has implemented various initiatives aimed at promoting energy efficiency and reducing carbon emissions. For instance, the introduction of stringent energy efficiency standards for electric motors is expected to drive innovation and adoption of more efficient technologies. By 2025, it is anticipated that around 60% of electric motors sold in China will comply with these new standards. Additionally, subsidies and incentives for manufacturers adopting energy-efficient solutions are likely to stimulate market growth. These regulatory frameworks not only encourage the development of advanced electric motors but also align with China's broader environmental goals, thereby positioning the electric motors market as a key player in the transition towards sustainable industrial practices.

Technological Advancements in Motor Design

Technological advancements in motor design are emerging as a significant driver for the electric motors market in China. Innovations such as brushless DC motors, permanent magnet motors, and high-efficiency designs are transforming the landscape of electric motors. These advancements not only improve performance but also enhance energy efficiency, which is increasingly demanded by consumers and industries alike. In 2025, it is estimated that high-efficiency motors will represent over 40% of the electric motors market. The integration of smart technologies, such as IoT and AI, into motor design is also expected to facilitate predictive maintenance and optimize performance. As manufacturers continue to invest in research and development, the electric motors market is likely to witness a wave of new products that cater to diverse applications, thereby driving overall market growth.