Increased Data Consumption

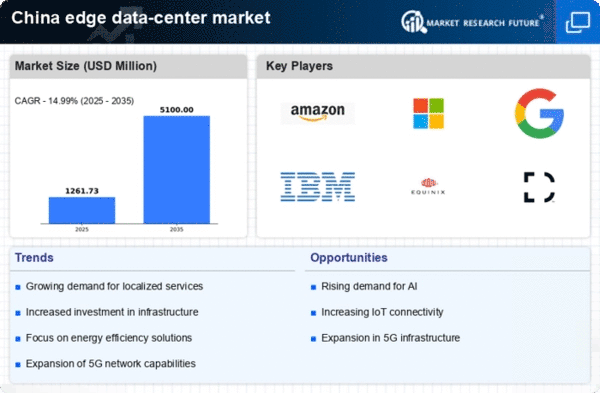

The edge data-center market in China is experiencing a surge in demand driven by the exponential growth of data consumption. With the proliferation of IoT devices and the expansion of 5G networks, data generation is expected to increase significantly. Reports indicate that data traffic in China could reach 48.5 zettabytes by 2030, necessitating localized data processing to reduce latency. This trend compels businesses to invest in edge data centers to ensure efficient data handling and real-time analytics. As a result, the edge data-center market is likely to see substantial growth, with projections suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. The need for faster data processing capabilities is thus a critical driver for the edge data-center market in China.

Proliferation of Smart Cities

The development of smart cities in China is significantly influencing the edge data-center market. As urban areas increasingly integrate technology to enhance infrastructure and services, the demand for localized data processing becomes paramount. Smart city initiatives require real-time data analytics for traffic management, public safety, and energy efficiency, which can only be achieved through edge computing solutions. The Chinese government has allocated substantial funding, estimated at $1 trillion, towards smart city projects by 2030. This investment is expected to drive the establishment of numerous edge data centers across urban areas, facilitating the efficient management of vast amounts of data generated by smart devices. Consequently, the edge data-center market is poised for robust growth as it supports the technological backbone of these urban developments.

Shift Towards Decentralized Computing

The edge data-center market in China is witnessing a shift towards decentralized computing models, driven by the need for enhanced data security and privacy. As data breaches and cyber threats become increasingly prevalent, organizations are seeking solutions that minimize risks associated with centralized data storage. Edge computing allows for data to be processed closer to its source, reducing the likelihood of exposure during transmission. This trend is particularly relevant in sectors such as finance and healthcare, where data sensitivity is paramount. The market for edge data centers is expected to grow as businesses prioritize security and compliance with stringent data protection regulations. Analysts predict that the demand for decentralized computing solutions will continue to rise, further solidifying the edge data-center market's role in the broader digital ecosystem.

Government Initiatives and Investments

The edge data-center market in China is benefiting from proactive government initiatives aimed at enhancing digital infrastructure. The Chinese government has recognized the importance of edge computing in supporting the digital economy and has introduced policies to promote its development. Investments in data center infrastructure are projected to exceed $200 billion by 2025, with a focus on building energy-efficient and sustainable facilities. These initiatives not only aim to improve connectivity and data processing capabilities but also to position China as a leader in the global digital landscape. The supportive regulatory framework and financial backing from the government are likely to stimulate growth in the edge data-center market, encouraging private sector participation and innovation.

Rising Adoption of AI and Machine Learning

The edge data-center market in China is being propelled by the increasing adoption of artificial intelligence (AI) and machine learning technologies. These advanced technologies require substantial computational power and low-latency data processing, which edge data centers are uniquely positioned to provide. As industries such as manufacturing, healthcare, and finance integrate AI solutions, the demand for edge computing capabilities is expected to rise. Market analysts suggest that the AI market in China could reach $30 billion by 2025, further driving the need for edge data centers to support these applications. The ability to process data closer to the source enhances the performance of AI algorithms, making edge data centers a vital component in the deployment of AI technologies across various sectors.