Rising Disposable Income

The rise in disposable income among the Chinese population is contributing to the expansion of the dental lasers market. As individuals experience increased financial stability, they are more likely to invest in their oral health and seek advanced dental treatments. This trend is particularly evident in urban areas, where higher income levels correlate with a greater willingness to pay for cosmetic and preventive dental procedures. The dental lasers market is poised to capitalize on this trend, as patients are increasingly opting for laser treatments that offer quicker recovery times and enhanced comfort. Market analysts suggest that the growth in disposable income could lead to a surge in demand for dental lasers, potentially increasing market revenues by 20% over the next few years.

Growing Awareness of Oral Health

The increasing awareness of oral health among the population in China is driving the dental lasers market. As individuals become more informed about the importance of dental hygiene and the benefits of advanced dental treatments, the demand for innovative solutions like dental lasers is likely to rise. This trend is supported by educational campaigns and initiatives from dental associations, which emphasize the advantages of laser technology in procedures such as cavity treatment and gum surgery. The dental lasers market is expected to benefit from this heightened awareness, as patients seek less invasive and more effective treatment options. Furthermore, the market could see a potential growth rate of around 15% annually as more dental practitioners adopt laser technology to meet patient expectations and improve treatment outcomes.

Government Initiatives and Support

Government initiatives aimed at improving healthcare infrastructure in China are positively impacting the dental lasers market. Policies that promote advanced medical technologies and support dental health initiatives are likely to encourage the adoption of laser systems in dental practices. The government has been investing in healthcare reforms that prioritize modern treatment options, which includes the use of dental lasers. This support may lead to increased funding for dental clinics to acquire advanced equipment, thereby expanding the market. As a result, the dental lasers market could experience a growth trajectory of approximately 12% as more clinics are equipped with state-of-the-art laser technology.

Shift Towards Minimally Invasive Procedures

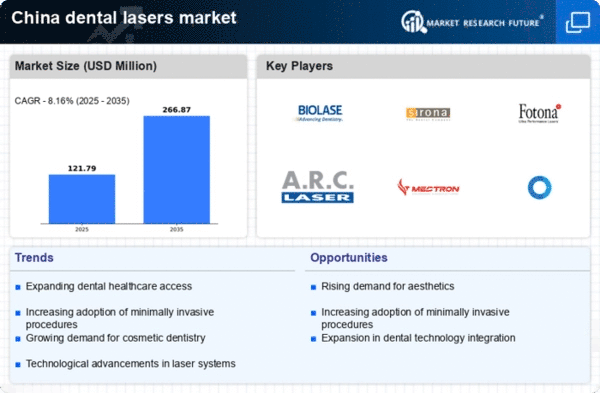

The shift towards minimally invasive dental procedures is significantly influencing the dental lasers market. Patients in China are increasingly favoring treatments that reduce discomfort and recovery time, which aligns with the capabilities of laser technology. Dental lasers offer a less invasive alternative to traditional methods, making them appealing to both practitioners and patients. This trend is likely to drive demand for laser systems, as more dental professionals seek to provide efficient and patient-friendly treatment options. The dental lasers market may see a growth rate of around 18% as the preference for minimally invasive techniques continues to rise, reflecting a broader shift in healthcare towards less traumatic procedures.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices is a key driver for the dental lasers market. As dental clinics in China adopt modern equipment and techniques, the demand for laser systems is likely to increase. This integration not only enhances the efficiency of dental procedures but also improves patient experiences. Laser technology allows for more precise treatments, reducing the need for anesthesia and minimizing recovery times. The dental lasers market is expected to grow as more practitioners recognize the benefits of incorporating lasers into their practices. With an estimated 30% of dental clinics in urban areas already utilizing laser technology, this trend is anticipated to continue, further propelling market growth.