Emergence of 5G Technology

The rollout of 5G technology in China is poised to revolutionize the data center-infrastructure market. With its promise of ultra-fast connectivity and low latency, 5G is expected to drive demand for edge computing solutions and decentralized data centers. This shift may lead to a transformation in how data is processed and stored, as organizations seek to leverage the capabilities of 5G for real-time applications. The data center-infrastructure market must adapt to these changes by investing in infrastructure that supports 5G networks, including micro data centers and enhanced network capabilities. As 5G adoption accelerates, the market is likely to witness a surge in demand for innovative data center solutions.

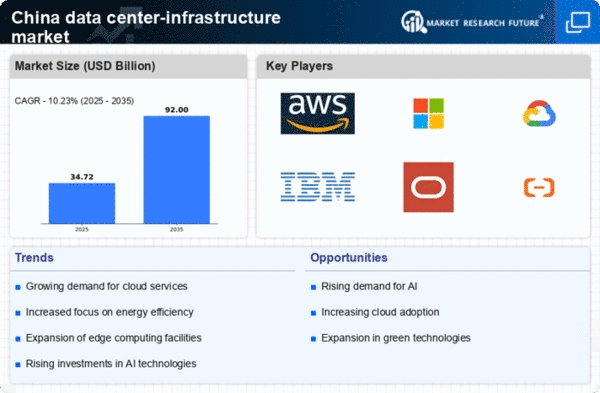

Rising Demand for Cloud Services

The data center-infrastructure market in China is experiencing a notable surge in demand for cloud services. As businesses increasingly migrate to cloud-based solutions, the need for robust data center infrastructure becomes paramount. In 2025, the cloud services market in China is projected to reach approximately $50 billion, indicating a growth rate of around 30% annually. This trend necessitates the expansion and enhancement of data center facilities to accommodate the growing volume of data and applications. Consequently, investments in advanced infrastructure, including servers, storage, and networking equipment, are likely to escalate. The data center-infrastructure market must adapt to these evolving requirements. This adaptation is essential to ensure scalability and reliability to support the burgeoning cloud ecosystem.

Increased Focus on Sustainability

Sustainability has emerged as a critical consideration in the data center-infrastructure market in China. As environmental concerns grow, organizations are increasingly prioritizing energy-efficient and eco-friendly data center solutions. The market is witnessing a shift towards renewable energy sources, with many data centers aiming to achieve carbon neutrality by 2030. This trend is likely to drive investments in energy-efficient technologies, such as advanced cooling systems and renewable energy integration. The data center-infrastructure market must respond to this demand by adopting sustainable practices and technologies, ensuring compliance with environmental regulations while meeting the needs of environmentally conscious consumers.

Government Initiatives and Regulations

The Chinese government plays a pivotal role in shaping the data center-infrastructure market through various initiatives and regulations. Policies aimed at promoting digital transformation and enhancing cybersecurity are driving investments in data center infrastructure. For instance, the implementation of the Cybersecurity Law has led to increased compliance requirements for data storage and processing. This regulatory landscape compels organizations to invest in secure and efficient data center solutions. Furthermore, the government's focus on developing smart cities and promoting green technology is likely to influence infrastructure design and operations. As a result, the data center-infrastructure market is expected to align with these governmental priorities, fostering innovation and compliance.

Growth of E-commerce and Digital Services

The rapid expansion of e-commerce and digital services in China is significantly impacting the data center-infrastructure market. With online retail sales projected to exceed $2 trillion by 2025, the demand for reliable and scalable data center solutions is intensifying. E-commerce platforms require robust infrastructure to handle vast amounts of transaction data, customer information, and inventory management. This growth necessitates the deployment of advanced data center technologies, including high-capacity servers and efficient cooling systems. As businesses strive to enhance their online presence, the data center-infrastructure market must evolve to support the increasing data processing and storage needs associated with e-commerce and digital services.