Rising Security Concerns

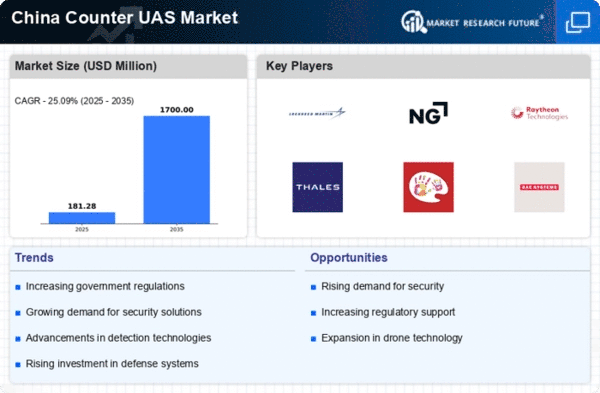

The counter UAS market in China is experiencing growth driven by escalating security concerns across various sectors. With the increasing prevalence of drones, there is a heightened awareness of potential threats posed by unauthorized UAVs. This has led to a surge in demand for counter-drone technologies, particularly in urban areas and critical infrastructure sites. The Chinese government has recognized the necessity of safeguarding public spaces and sensitive locations, prompting investments in counter uas systems. In 2025, the market is projected to reach approximately $1.5 billion, reflecting a compound annual growth rate (CAGR) of around 15%. This growth indicates a robust response to the perceived risks associated with drone operations, thereby solidifying the counter uas market's position as a vital component of national security strategies.

Technological Integration

The integration of advanced technologies into counter uas systems is a significant driver for the counter uas market in China. Innovations such as artificial intelligence (AI), machine learning, and advanced radar systems are enhancing the effectiveness of counter-drone solutions. These technologies enable real-time threat detection and response, which is crucial for addressing the dynamic nature of drone threats. As of November 2025, the market is witnessing a shift towards more sophisticated systems that can autonomously identify and neutralize unauthorized UAVs. This trend is expected to contribute to a market valuation of approximately $1.8 billion by the end of the year, indicating a strong inclination towards technological advancements in the counter uas market.

Commercial Sector Expansion

The expansion of the commercial sector in China is significantly influencing the counter uas market. As industries such as logistics, agriculture, and construction increasingly adopt drone technology, the need for counter-drone solutions becomes more pronounced. In 2025, it is projected that the commercial segment will account for over 40% of the total market share, driven by the necessity to protect assets and ensure operational integrity. Companies are investing in counter uas systems to mitigate risks associated with drone interference, thereby fostering a conducive environment for business operations. This trend highlights the growing recognition of the counter uas market as an essential component of commercial strategy in various sectors.

Government Initiatives and Funding

Government initiatives play a pivotal role in shaping the counter uas market in China. The Chinese government has been actively promoting the development and deployment of counter-drone technologies through various funding programs and policy frameworks. In 2025, it is estimated that government funding for counter uas projects will exceed $500 million, aimed at enhancing national security and public safety. This financial support is likely to stimulate innovation and encourage collaboration between public and private sectors, thereby accelerating the growth of the counter uas market. The emphasis on developing indigenous technologies further underscores the strategic importance of this market in China's defense and security landscape.

International Collaboration and Trade

International collaboration and trade are emerging as influential factors in the counter uas market in China. As the global landscape for drone technology evolves, partnerships with foreign entities are becoming increasingly common. These collaborations facilitate knowledge transfer and access to advanced counter-drone technologies, which can enhance the capabilities of domestic systems. In 2025, it is anticipated that joint ventures and technology exchanges will contribute to a market growth rate of approximately 12%. This trend underscores the importance of global cooperation in addressing the challenges posed by UAVs, thereby reinforcing the counter uas market's role in China's strategic defense initiatives.