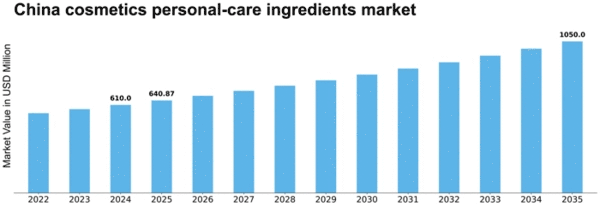

China Cosmetics Personal Care Ingredients Size

China Cosmetics Personal Care Ingredients Market Growth Projections and Opportunities

The cosmetics and personal care ingredients market in the Middle East and North Africa (MENA), Gulf Cooperation Council (GCC), and China is influenced by a myriad of market factors that shape its dynamics. In the MENA region, the market is driven by a growing population, rising disposable incomes, and an increasing awareness of personal grooming. Consumers in this region are increasingly seeking high-quality and innovative cosmetic products, leading to a surge in demand for diverse ingredients. The GCC countries, in particular, are witnessing a shift towards natural and organic ingredients, driven by a rising preference for sustainable and eco-friendly products.

China, on the other hand, plays a significant role in the cosmetics and personal care ingredients market due to its sheer size and evolving consumer preferences. With a burgeoning middle class and a focus on beauty and personal well-being, the Chinese market is characterized by a robust demand for a wide array of cosmetic ingredients. Chinese consumers are becoming more discerning, placing emphasis on products that cater to specific skin concerns, and this has led to a surge in demand for specialized ingredients such as anti-aging compounds and skin brightening agents.

Trade policies and regulations also shape the cosmetics and personal care ingredients market in these regions. The GCC countries, known for their oil-based economies, have been diversifying their economic base, and the cosmetics industry is a strategic focus. The governments in these regions are increasingly implementing regulations to ensure product safety, quality, and compliance with international standards. Similarly, China has implemented regulatory changes to improve the safety and efficacy of cosmetic products, impacting the types of ingredients used and the overall market landscape.

Global economic trends and geopolitical factors also influence the cosmetics and personal care ingredients market in the MENA, GCC, and China. Economic stability, currency exchange rates, and international trade relations impact the cost of raw materials and the pricing of finished products. Moreover, geopolitical events can disrupt supply chains and impact the availability of certain ingredients. As these regions continue to integrate into the global economy, their cosmetics markets are becoming more interconnected with international trends and developments.

Innovation and technological advancements are key drivers in the cosmetics and personal care ingredients market. Consumers in the MENA, GCC, and China are increasingly seeking products that offer unique formulations, improved efficacy, and sustainable solutions. This has led to a surge in research and development activities, with companies investing in cutting-edge technologies to develop novel ingredients. The demand for natural and organic ingredients, driven by a global shift towards cleaner beauty products, has also spurred innovation in these markets.

Consumer behavior and cultural influences play a crucial role in shaping the cosmetics and personal care ingredients market in the MENA, GCC, and China. Preferences for specific textures, scents, and traditional remedies influence the formulation of products. In the MENA region, for instance, there is a preference for products that cater to specific skin needs in the arid climate, while in China, cultural elements such as traditional Chinese medicine impact the choice of ingredients.

Leave a Comment