Increased Focus on Personalized Medicine

An increased focus on personalized medicine is emerging as a key driver in the computer vision-healthcare market in China. The shift towards tailored treatment plans necessitates advanced diagnostic tools that can analyze vast amounts of data to provide insights into individual patient needs. Computer vision technologies are being integrated into personalized medicine approaches, enabling healthcare providers to deliver more effective and targeted therapies. This trend is expected to propel market growth, with estimates suggesting that the personalized medicine segment could account for over 40% of the overall healthcare market by 2027. Such a focus on individualized care is likely to enhance patient satisfaction and treatment outcomes.

Growing Investment in Health Tech Startups

The computer vision-healthcare market in China is witnessing a surge in investment directed towards health tech startups. Venture capitalists and private equity firms are increasingly recognizing the potential of computer vision technologies to revolutionize healthcare delivery. This influx of capital is facilitating the development of innovative solutions that leverage computer vision for diagnostics, patient monitoring, and treatment planning. Reports suggest that investment in health tech startups could exceed $5 billion annually, reflecting a strong belief in the transformative power of technology in healthcare. As these startups emerge, they are likely to contribute significantly to the overall growth of the computer vision-healthcare market.

Government Initiatives to Promote Digital Health

Government initiatives aimed at promoting digital health are playing a pivotal role in shaping the computer vision-healthcare market in China. Policies that encourage the adoption of innovative technologies in healthcare are being implemented to enhance service delivery and patient care. For instance, the Chinese government has allocated substantial funding to support research and development in digital health technologies, including computer vision applications. This support is expected to drive market growth, with projections indicating a potential increase in market size by over 30% in the next few years. Such initiatives not only foster innovation but also create a conducive environment for startups and established companies in the healthcare sector.

Rising Demand for Efficient Healthcare Solutions

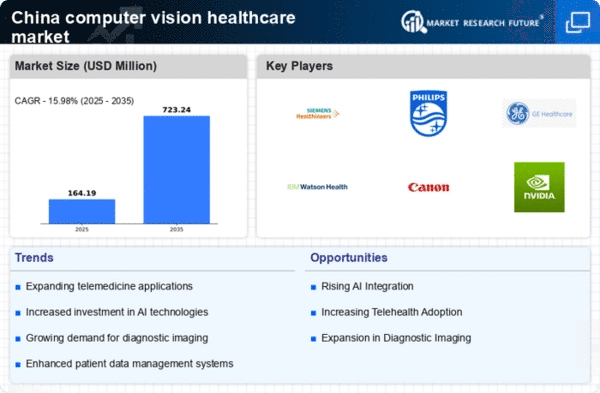

the market in China is experiencing a notable surge in demand for efficient healthcare solutions.. This demand is driven by an increasing population and a growing prevalence of chronic diseases, which necessitate advanced diagnostic tools. The integration of computer vision technologies into healthcare systems is seen as a viable solution to enhance diagnostic accuracy and reduce operational costs. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of the healthcare sector's shift towards more automated and precise methodologies, which are essential for managing the rising patient load effectively.

Technological Advancements in Imaging Techniques

Technological advancements in imaging techniques are significantly influencing the computer vision-healthcare market in China. Innovations such as deep learning algorithms and enhanced imaging modalities are enabling healthcare professionals to achieve higher diagnostic precision. These advancements facilitate the early detection of diseases, which is crucial for effective treatment. The market for medical imaging is expected to reach approximately $10 billion by 2026, reflecting a robust growth trajectory. As hospitals and clinics increasingly adopt these technologies, the demand for computer vision applications in healthcare is likely to expand, thereby improving patient outcomes and operational efficiencies.