Growing E-commerce Sector

The rapid expansion of the e-commerce sector in China appears to be a primary driver for the china buy now pay later market. As of January 2026, e-commerce sales in China are projected to reach approximately 2 trillion USD, indicating a robust consumer shift towards online shopping. This trend is likely to encourage the adoption of buy now pay later services, as consumers seek flexible payment options to manage their budgets. The integration of these services into e-commerce platforms enhances the shopping experience, allowing consumers to make purchases without immediate financial strain. Consequently, the china buy now pay later market is expected to flourish as more online retailers adopt these payment solutions, catering to the evolving preferences of tech-savvy consumers.

Regulatory Support and Frameworks

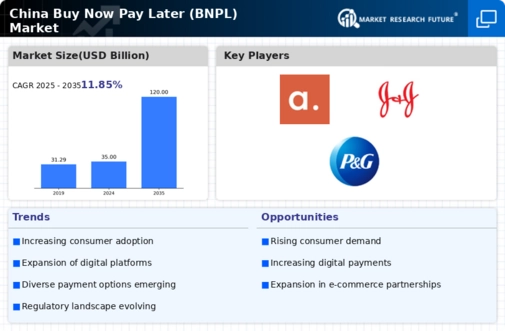

The regulatory environment surrounding the china buy now pay later market is evolving, with government initiatives aimed at promoting financial inclusion. Recent policies suggest that authorities are increasingly recognizing the potential of buy now pay later services to enhance consumer access to credit. By establishing clear guidelines and frameworks, the government appears to be fostering a more secure and transparent market. This regulatory support may encourage more financial institutions to enter the buy now pay later space, thereby increasing competition and innovation. As a result, the china buy now pay later market could witness significant growth, driven by a more favorable regulatory landscape that supports responsible lending practices.

Increased Financial Literacy Initiatives

The focus on financial literacy and consumer education is emerging as a vital driver for the china buy now pay later market. As consumers become more informed about their financial options, they are more likely to engage with buy now pay later services responsibly. Recent initiatives by both government and private sectors aim to enhance financial literacy among consumers, particularly targeting younger audiences. These efforts appear to be yielding positive results, as awareness of buy now pay later options increases. Educated consumers are likely to make more informed decisions regarding their financial commitments, which could lead to a healthier market environment. Therefore, the china buy now pay later market may experience growth as financial literacy initiatives empower consumers to utilize these services effectively.

Technological Advancements in Payment Solutions

Technological innovations are playing a crucial role in shaping the china buy now pay later market. The proliferation of mobile payment platforms and digital wallets has made it easier for consumers to access buy now pay later services. As of January 2026, it is estimated that over 80% of Chinese consumers utilize mobile payment solutions, indicating a strong preference for digital transactions. This trend suggests that the integration of buy now pay later options into existing payment systems could enhance consumer adoption. Furthermore, advancements in data analytics and artificial intelligence are enabling providers to assess creditworthiness more accurately, potentially reducing default rates. Thus, the china buy now pay later market is likely to benefit from these technological advancements, leading to increased consumer trust and usage.

Rising Consumer Demand for Flexible Payment Options

The increasing consumer demand for flexible payment solutions is a significant driver of the china buy now pay later market. As consumers become more financially conscious, they are seeking alternatives to traditional credit options. The buy now pay later model allows consumers to make purchases while spreading payments over time, which appears to resonate particularly well with younger demographics. Recent surveys indicate that nearly 60% of millennials in China prefer using buy now pay later services for their online purchases. This shift in consumer behavior suggests that the market is poised for growth, as more individuals opt for payment flexibility. Consequently, the china buy now pay later market is likely to expand in response to this evolving consumer preference.