Rising Cybersecurity Threats

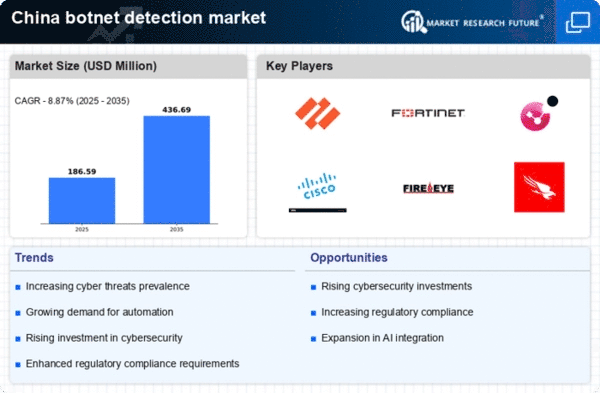

The botnet detection market is experiencing growth due to the increasing frequency and sophistication of cyber threats in China. As organizations face a surge in DDoS attacks and other malicious activities, the demand for effective botnet detection solutions is escalating. In 2025, it is estimated that cybercrime could cost the Chinese economy over $100 billion annually, highlighting the urgency for robust cybersecurity measures. This environment fosters a strong market for botnet detection technologies, as businesses seek to protect their assets and maintain operational integrity. The botnet detection market is thus positioned to expand significantly, driven by the need for advanced threat detection and mitigation strategies.

Evolving Regulatory Landscape

The evolving regulatory landscape in China is shaping the botnet detection market. New regulations aimed at enhancing data protection and cybersecurity are being introduced, compelling organizations to adopt advanced detection solutions. Compliance with these regulations is not only a legal obligation but also a strategic necessity for businesses to maintain consumer trust. In 2025, it is projected that compliance-related investments in cybersecurity could reach $5 billion, driving demand for botnet detection technologies. The botnet detection market is therefore likely to see increased activity as companies strive to meet regulatory requirements and protect sensitive information.

Increased Internet Penetration

China's rapid internet penetration, with over 1 billion users as of 2025, is a significant driver for the botnet detection market. As more individuals and businesses connect online, the potential for cyber threats increases, necessitating effective detection solutions. The rise in connected devices, particularly IoT devices, further complicates the cybersecurity landscape, making it imperative for organizations to invest in botnet detection technologies. The botnet detection market is thus poised for growth, as companies seek to safeguard their networks and data from emerging threats associated with increased internet usage.

Government Initiatives and Support

The Chinese government is actively promoting cybersecurity initiatives, which significantly impacts the botnet detection market. With the implementation of policies aimed at enhancing national security and protecting critical infrastructure, there is a growing emphasis on advanced cybersecurity solutions. The government has allocated substantial funding, estimated at $2 billion in 2025, to bolster cybersecurity capabilities across various sectors. This support encourages the development and adoption of botnet detection technologies, as organizations align with national standards and regulations. Consequently, the botnet detection market is likely to benefit from these initiatives, fostering innovation and collaboration among stakeholders.

Growing Awareness of Cybersecurity Risks

There is a growing awareness of cybersecurity risks among businesses and consumers in China, which is positively influencing the botnet detection market. As high-profile cyber incidents make headlines, organizations are becoming more proactive in addressing potential vulnerabilities. This heightened awareness is leading to increased investments in cybersecurity solutions, including botnet detection technologies. In 2025, it is anticipated that spending on cybersecurity in China will exceed $20 billion, reflecting the urgency to combat cyber threats. The botnet detection market stands to gain from this trend, as companies prioritize the implementation of effective detection and response strategies.